Trump trial gets underway with opening statements and first witness

Jurors in former President Donald Trump's criminal trial in New York got their first glimpse of the arguments both sides plan to make.

Watch CBS News

Jurors in former President Donald Trump's criminal trial in New York got their first glimpse of the arguments both sides plan to make.

As of the end of March, more than 187,000 Ukrainians have arrived in the U.S. under the Uniting for Ukraine program, resettling with resounding efficiency and relatively little controversy.

Laura Kowal's match on an online dating site wasn't what he seemed. Now her daughter is on a mission to expose the risk of romance scams: "It could happen to anybody."

Those who prioritize climate change feel somewhat unsatisfied — more of them feel Biden has done too little.

The Supreme Court considered whether efforts to address homelessness in Grants Pass, Oregon, violated the Constitution's prohibition on cruel and unusual punishment.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

After a U.S. investment of about $1 billion in Niger, the welcome mat is being yanked out from under American troops' feet.

New York Attorney General Letitia James's office argued it is concerned about the financial wherewithal of Knight Specialty Insurance company, which posted the bond for former President Donald Trump.

The NYPD moved in on the encampment at NYU and started making arrests on Monday night.

Protesters have been arrested at Columbia and Yale as they've refused to move, calling for a break from Israel.

The Supreme Court hears arguments Wednesday in a case about whether Idaho's near-total ban on abortion is preempted by Emergency Medical Treatment and Labor Act, or EMTALA.

Facing widespread unhappiness over its response to the Israel-Hamas war, the writers' group PEN America has called off its annual awards ceremony.

Karen, a "vibrant and beloved ostrich" at the Topeka Zoo, died after swallowing keys she nabbed from a staffer, the zoo announced on Facebook last week.

Matthew Hussey hosts the popular podcast "Love Life with Matthew Hussey."

Millions of Americans filed their taxes during the last two weeks of this year's tax season. Here's how to find out when you'll get your refund.

A tiny baby rescued from the womb after an Israeli airstrike in Gaza killed her mother is doing well after being moved to a new hospital.

A new report calls for further study into a possible link between chronic wasting disease in deer and a rare and deadly brain disease in humans.

Terry Anderson, the globe-trotting Associated Press correspondent who became one of America's longest-held hostages, has died at age 76.

The person self-immolated at a park across from the courthouse and, the NYPD confirmed to CBS News, later died.

The jury selection process wrap-up was part of a flurry of activity that marked the end of a dizzying first week.

Under the 5th Amendment, the jury is prohibited from holding it against him if he doesn't testify.

Scientists are working to protect endangered species that could disappear in coming decades.

A disappearing lizard population in Arizona shows how climate change is fast-tracking the rate of extinction.

This Earth Day, learn about the millions of species of plants and animals – and the vital role they all play in the planet's future.

The RNC announced an ambitious initiative to monitor vote processing in the 2024 presidential election.

This appears to mean only a pro-abortion rights measure may qualify for the Colorado ballot this fall.

They backed the president even as their brother makes his own bid for Biden's job.

The strike hit a residential building in a Rafah neighborhood, according to Gaza's civil defense.

Two U.S. officials tell CBS News an Israeli missile hit Iran in apparent retaliation for the recent drone and missile attack on Israel.

The Treasury Department announced sanctions on two entities accused of fundraising for extremist West Bank settlers.

5.55% is an impressive high-yield savings account interest rate. But how much money would you earn with it?

If you're in your 80s, you may be wondering if you can still qualify for long-term care insurance. Find out here.

Considering investing in physical gold? Here are three reasons why you should do so this month.

Cancer, heart disease, respiratory illnesses and kidney dysfunction among the health consequences of a warming planet.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

UAW claims historic victory, with an overwhelming majority of VW workers at Chattanooga factory voting to unionize.

Tesla reduced prices by $2,000 on three of its five models in the U.S. and also slashed prices in China and Germany.

A "concierge service" that lets paying members bypass airport security lines is unfair to other travelers, California lawmaker says.

It's Jokic vs. James. Here's how and when to watch today's Los Angeles Lakers vs. Denver Nuggets NBA playoff game.

Discover what's new in the 2024 edition of Samsung's popular Frame smart art TV.

Find out how and when to watch the Philadelphia 76ers vs. New York Knicks NBA Playoff game today.

Prosecutors alleged in their opening statement that former President Trump committed election interference and falsified business records to pay off adult film star Stormy Daniels in the leadup to the 2016 election. Trump's defense attorneys, however, claimed that no crime was committed. Robert Costa has more on the start of the "hush money" trial.

The U.S. is investigating Israel's Netsvah Yehuda Battalion, made up of ultra-orthodox soldiers, over accusations of human rights violations in the Israeli-occupied West Bank. Debora Patta has the details.

Students in Tennessee walked out of school on Monday to protest a bill that would allow teachers to carry concealed firearms in the classroom. Mark Strassmann has the story.

A widow looking for love was scammed out of $1.5 million before her tragic death. Her daughter is now on a mission to share her mom's story, hoping it spurs change.

A widow looking for love was scammed out of $1.5 million before her tragic death. Her daughter is now on a mission to share her mom's story, hoping it spurs change.

The U.S. is investigating Israel's Netsvah Yehuda Battalion, made up of ultra-orthodox soldiers, over accusations of human rights violations in the Israeli-occupied West Bank. Debora Patta has the details.

Prosecutors alleged in their opening statement that former President Trump committed election interference and falsified business records to pay off adult film star Stormy Daniels in the leadup to the 2016 election. Trump's defense attorneys, however, claimed that no crime was committed. Robert Costa has more on the start of the "hush money" trial.

Students in Tennessee walked out of school on Monday to protest a bill that would allow teachers to carry concealed firearms in the classroom. Mark Strassmann has the story.

A global shark census found in 2018 that the population of five main reef shark species, which are key to balancing the ecosystem of coral reefs, had declined 63%. Ben Tracy takes a look at a group working to protect these necessary predators.

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

Former Miss USA and Extra correspondent Cheslie Kryst shared her excitement about writing her first book, finishing the manuscript shortly before she died by suicide in 2022, at age 30. Her family says she battled severe depression for years. Now, her mother, April Simpkins, is honoring her daughter's wish by publishing her book. It's called "By the Time You Read This: The Space Between Cheslie's Smile and Mental Illness." April Simpkins joins us first on "CBS Mornings." For more information on Cheslie Kryst go to cheslieckrystfoundation.org

Taylor Swift’s new album, “The Tortured Poets Department,'' became Spotify’s most-streamed album in a single day while selling 1.6 million units. It’s on track to sell more than 2 million copies in its first week

One of San Francisco's oldest LGBTQ bars, on Saturday the Stud re-opened it's doors for the first time in four years at a new location.

The singer and actress began a new career when she teamed with daughter Emma Walton Hamilton to write a hugely successful series of children's books. Their 35th, "Waiting in the Wings," about a troupe of theatrical ducks, is based on a true story.

For the past two years, the U.S. has been quietly resettling hundreds of thousands of Ukrainian refugees. CBS News immigration and politics reporter Camilo Montoya-Galvez spoke with one of the families that escaped war and now live and work in New Jersey.

A growing form of fraud is posing physical, emotional, and financial threats to everyday Americans. Jim Axelrod reports on a romance scam turned tragic -- when a widow was swindled out of her life savings.

Despite how terrifying sharks might seem, the creatures are critical to the survival of the world's oceans. Oceans generate 50% of the oxygen on the planet and absorb 90% of excess heat created by global warming. CBS News senior national and environmental correspondent Ben Tracy spoke with conservationists in the Bahamas.

2024 kicked off with the highest number of drug shortages on record. CBS News reporter Erica Brown explains why some medications are harder to find and what's being done to fix the problem.

Secretary of Commerce Gina Raimondo is at the center of a global competition for semiconductor dominance. It's a battle that also puts her at the center of two of the hottest global national security hotspots. Lesley Stahl of 60 Minutes spoke with Raimondo for the broadcast.

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

A mom was worried about what her son, who has autism, would do after high school. So she opened the So Much To Give cafe, a restaurant in Cedars, Pennsylvania, that employs people with disabilities – and helps them grow.

A mom worried about her son with autism opens an inclusive cafe that employs people with disabilities. The community around Paradise, California, rallies behind a woman whose beloved pet was stolen. Plus, more heartwarming stories.

Charlie Bird — the "major Swiftie" of the two — had the idea after the singer announced her new album "The Tortured Poets Department" at the Grammys.

David Begnaud has the story of an unlikely friendship at a Massachusetts elementary school, proving that words are not always necessary to form a special connection.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

Karen, a "vibrant and beloved ostrich" at the Topeka Zoo, died after swallowing keys she nabbed from a staffer, the zoo announced on Facebook last week.

As of the end of March, more than 187,000 Ukrainians have arrived in the U.S. under the Uniting for Ukraine program, resettling with resounding efficiency and relatively little controversy.

The NYPD moved in on the encampment at NYU and started making arrests on Monday night.

Laura Kowal's match on an online dating site wasn't what he seemed. Now her daughter is on a mission to expose the risk of romance scams: "It could happen to anybody."

Proposed deal "threatens to deprive consumers of the competition for affordable handbags," federal agency says.

Proposed deal "threatens to deprive consumers of the competition for affordable handbags," federal agency says.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

Cancer, heart disease, respiratory illnesses and kidney dysfunction among the health consequences of a warming planet.

A "concierge service" that lets paying members bypass airport security lines is unfair to other travelers, California lawmaker says.

Tesla reduced prices by $2,000 on three of its five models in the U.S. and also slashed prices in China and Germany.

As of the end of March, more than 187,000 Ukrainians have arrived in the U.S. under the Uniting for Ukraine program, resettling with resounding efficiency and relatively little controversy.

The NYPD moved in on the encampment at NYU and started making arrests on Monday night.

Protesters have been arrested at Columbia and Yale as they've refused to move, calling for a break from Israel.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

Those who prioritize climate change feel somewhat unsatisfied — more of them feel Biden has done too little.

Cancer, heart disease, respiratory illnesses and kidney dysfunction among the health consequences of a warming planet.

To reduce recidivism, some rural counties are hiring community health workers or peer support specialists to connect people leaving custody to mental health, substance use treatment, medical services and jobs.

The CDC estimates the U.S. could reach 300 measles cases in 2024 — more than the recent peak two years ago.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

A landmark review for Britain's National Health Service found young people have been let down by "remarkably weak" evidence backing medical interventions in gender care.

As of the end of March, more than 187,000 Ukrainians have arrived in the U.S. under the Uniting for Ukraine program, resettling with resounding efficiency and relatively little controversy.

The NYPD moved in on the encampment at NYU and started making arrests on Monday night.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

Cancer, heart disease, respiratory illnesses and kidney dysfunction among the health consequences of a warming planet.

After a U.S. investment of about $1 billion in Niger, the welcome mat is being yanked out from under American troops' feet.

Facing widespread unhappiness over its response to the Israel-Hamas war, the writers' group PEN America has called off its annual awards ceremony.

The Spice Girls had a reunion on Saturday and even put on an impromptu performance.

Former Miss USA and Extra correspondent Cheslie Kryst shared her excitement about writing her first book, finishing the manuscript shortly before she died by suicide in 2022, at age 30. Her family says she battled severe depression for years. Now, her mother, April Simpkins, is honoring her daughter's wish by publishing her book. It's called "By the Time You Read This: The Space Between Cheslie's Smile and Mental Illness." April Simpkins joins us first on "CBS Mornings." For more information on Cheslie Kryst go to cheslieckrystfoundation.org

Best-selling author and dating coach Matthew Hussey, known for his popular podcast "Love Life with Matthew Hussey" and his popular YouTube videos, unveils his new book, "Love Life: How to Raise Your Standards, Find Your Person, and Live Happily -- No Matter What."

Taylor Swift’s new album, “The Tortured Poets Department,'' became Spotify’s most-streamed album in a single day while selling 1.6 million units. It’s on track to sell more than 2 million copies in its first week

Secretary of Commerce Gina Raimondo is at the center of a global competition for semiconductor dominance. It's a battle that also puts her at the center of two of the hottest global national security hotspots. Lesley Stahl of 60 Minutes spoke with Raimondo for the broadcast.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

More than 100 nations, including the United States, have agreed to protect 30% of the world's oceans by 2030.

More than 100 nations have agreed to protect 30% of the world’s oceans by 2030. One way of doing this is to create what are known as Marine Protected Areas, where human activity is restricted or banned. Ben Tracy reports on how a mix of AI and satellite vessel tracking data can help.

A photo taken two days after the sinking of the RMS Titanic apparently shows the iceberg that doomed the so-called unsinkable ship in 1912. CBS News' John Dickerson has details.

Despite how terrifying sharks might seem, the creatures are critical to the survival of the world's oceans. Oceans generate 50% of the oxygen on the planet and absorb 90% of excess heat created by global warming. CBS News senior national and environmental correspondent Ben Tracy spoke with conservationists in the Bahamas.

A new CBS poll finds that most of the public favors the U.S. taking steps to address climate change. CBS News executive director of elections and surveys Anthony Salvanto breaks down the numbers.

Climate change could cause a $38 trillion income loss per year globally by 2049, according to a new study by the Potsdam Institute for Climate Impact Research. CBS News' Lilia Luciano breaks down the numbers.

A recent report by the United Nations warned that 1 million species are at risk of extinction because of climate-related issues, and some scientists say the number could be even higher. CBS News national environmental correspondent David Schechter has more.

A growing form of fraud is posing physical, emotional, and financial threats to everyday Americans. Jim Axelrod reports on a romance scam turned tragic -- when a widow was swindled out of her life savings.

Laura Kowal's match on an online dating site wasn't what he seemed. Now her daughter is on a mission to expose the risk of romance scams: "It could happen to anybody."

Jurors in former President Donald Trump's criminal trial in New York got their first glimpse of the arguments both sides plan to make.

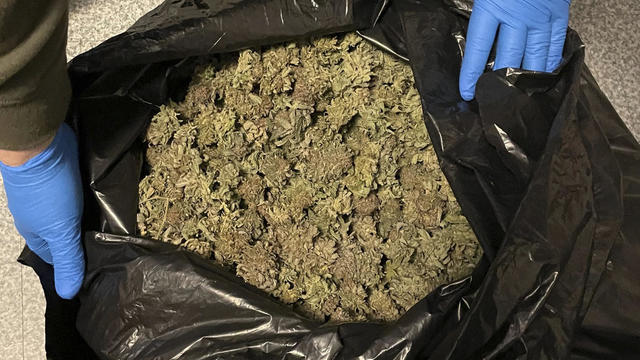

Federal law enforcement officials have brought charges against Xisen Guo, who is accused of creating an illicit marijuana-growing operation off the beaten path in rural Maine.

Officials say the story of a woman found dead, her savings drained, after meeting a con artist on an online dating site is part of a national crisis unfolding largely in secret.

A process called cryopreservation allows cells to remain frozen but alive for hundreds of years. For some animal cells, the moon is the closest place that's cold enough.

The Lyrid meteor show is set to peak as the week begins.

April's full moon, known as the Pink Moon, will reach peak illumination on Tuesday, but it will appear full from Monday morning through Thursday morning.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

A photo taken two days after the sinking of the RMS Titanic apparently shows the iceberg that doomed the so-called unsinkable ship in 1912. CBS News' John Dickerson has details.

For the past two years, the U.S. has been quietly resettling hundreds of thousands of Ukrainian refugees. CBS News immigration and politics reporter Camilo Montoya-Galvez spoke with one of the families that escaped war and now live and work in New Jersey.

A growing form of fraud is posing physical, emotional, and financial threats to everyday Americans. Jim Axelrod reports on a romance scam turned tragic -- when a widow was swindled out of her life savings.

Despite how terrifying sharks might seem, the creatures are critical to the survival of the world's oceans. Oceans generate 50% of the oxygen on the planet and absorb 90% of excess heat created by global warming. CBS News senior national and environmental correspondent Ben Tracy spoke with conservationists in the Bahamas.

2024 kicked off with the highest number of drug shortages on record. CBS News reporter Erica Brown explains why some medications are harder to find and what's being done to fix the problem.