Supreme Court appears divided over obstruction law used in Jan. 6 cases

The Supreme Court seemed divided over a case challenging the scope of a federal obstruction law that prosecutors have used to charge more than 300 Jan. 6 defendants.

Watch CBS News

The Supreme Court seemed divided over a case challenging the scope of a federal obstruction law that prosecutors have used to charge more than 300 Jan. 6 defendants.

Maine is the newest frontier for the illicit marijuana trade, with potentially hundreds of suspected unlicensed grow houses operating in the state.

O.J. Simpson's former attorney and the current executor of his estate previously said he hoped the Goldman family would get "zero, nothing."

House Speaker Mike Johnson said Tuesday he won't resign, as another lawmaker calls for him step down or face an effort to remove him from the top post.

Jury selection in former President Donald Trump's historic criminal trial in New York is continuing for a second day on Tuesday.

The union for American Airlines pilots says it's been seeing "a significant spike in safety- and maintenance-related problems in our operation."

"Grief has come to us in waves. Moments of feeling absolutely gutted... then moments of feeling blessed by just getting a moment with her," the couple said.

Normally parched roads and airport runways in the desert city-state of Dubai were left underwater by an incredibly rare rainstorm.

Bella Hadid raised eyebrows after sharing her elaborate morning routine on TikTok, and other over-the-top celebrity self-care rituals are everywhere. Here's what experts suggest you aim for instead.

Trump's trial will feature a unique cast of characters.

The case stems from a "hush money" payment of $130,000 to adult film star Stormy Daniels in 2016.

Potential jurors are facing a quiz like none other while being considered for a seat at Donald Trump's New York trial.

A Sudanese-American family is the first to be reunited in the U.S. after a woman and her sons spent nearly a year stuck in Saudi Arabia.

Bayer has been lobbying lawmakers in three states to pass bills providing it legal protection from suits claiming Roundup causes cancer. Experts say such a measure could have much broader implications.

A fourth body was recovered Sunday at the site of the Key Bridge collapse, according to the Unified Command.

The 17th-century building's iconic spire, thought to protect the building "against enemy attacks and fires," collapsed among the flames.

Caitlin Clark has been selected with the No. 1 pick in the WNBA draft by the Indiana Fever.

Nike's unitard for female track and field athletes representing the U.S. at the 2024 Paris Olympics is too revealing, critics say.

USC's valedictorian will not be permitted to deliver a speech at the university's commencement ceremony due to concerns about security, the school's provost announced.

ABBA, Blondie and The Notorious B.I.G. are entering America's audio canon.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

President Biden believes painting former President Trump as a "threat" to democracy is a crucial contrast to highlight in his campaign.

The casll came in a joint statement by twelve major news organizations including CBS News.

The Democratic National Committee paid it to firms representing Biden during special counsel Robert Hur's investigation.

Details emerge of Iran's unprecedented direct attack on Israel, and how it was largely thwarted by the U.S. ally's defenses.

President Biden and Israeli Prime Minister Benjamin Netanyahu had a "good conversation," an official said.

President's handling hits new lows; Democrats have grown less supportive of aid to Israel.

There are multiple types of long-term care insurance to choose from. Learn more about cash benefit policies here.

It can be advantageous for homebuyers to pursue these strategies now before the Fed meets again on April 30.

Borrowing money from your home's equity can make a lot of sense in these circumstances.

The former president's media company has had a rough welcome on Wall Street, shedding two-thirds of its value since its peak.

Dream condiment now a reality: Heinz Classic Barbiecue Sauce available in the U.K. and Spain. Will "Kenchup" be next?

"It must be done," Tesla CEO Elon Musk said in a memo about the layoffs sent to employees on Sunday.

Nike's unitard for female track and field athletes representing the U.S. at the 2024 Paris Olympics is too revealing, critics say.

The housing market continues to be challenging for both buyers and sellers this year, as mortgage rates and asking prices continue to climb

Receive a $40 Digital Costco Shop Card when you join as a new member at Costco.com when entering PARA24 at checkout.

Here's what differentiates a standard Sam's Club membership from Sam's Club Plus.

Here's a roundup of laptops that cost $1,000 or less, but that can easily handle your everyday computing tasks.

House Speaker Mike Johnson is moving to help Israel, Ukraine and Taiwan by splitting a foreign aid bill into pieces to bypass some fellow Republicans who object to sending more money to Ukraine. CBS News congressional correspondent Nikole Killion has more.

American Airlines' pilots union is reporting a significant spike in safety and maintenance-related problems at the carrier, telling pilots to be vigilant. The union's concerns, spelled out in a memo obtained by CBS News, include tools left in wheels, more aircraft collisions while they are being towed and an increase in items left in the safety area near jet bridges. CBS News senior travel adviser Peter Greenberg has more.

Jury selection resumes Tuesday morning in Donald Trump's "hush money" case. Trump faces 34 felony counts for allegedly falsifying business records in order to hide an alleged affair with former adult film star Stormy Daniels, charges he denies. Those in the courtroom Monday say Trump appeared irritated and bored at times. CBS News chief election and campaign correspondent Robert Costa has more.

There is disagreement in Israel over how to respond to Iran's weekend attack as world leaders call on the Israelis to show restraint. CBS News' Debora Patta and Samantha Vinograd have more on the dynamics in play for Israeli Prime Minister Benjamin Netanyahu, who is facing immense pressure and criticism.

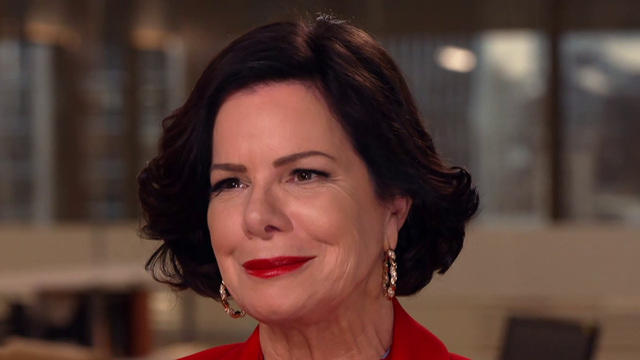

Actor Marcia Gay Harden sits down with Seth Doane to discuss her CBS series "So Help Me Todd," her LGBTQ+ activism and her love of pottery. Then, Jonathan Vigliotti meets Julian Curi, the filmmaker behind the short film "Gruff." "Here Comes the Sun" is a closer look at some of the people, places and things we bring you every week on "CBS Sunday Morning."

Comedian and actor Kevin James sits down with Jim Axelrod to discuss his Amazon Prime special "Kevin James: Irregardless,” and the journey he has taken throughout his career. Then, Robert Costa visits the National Gallery of Art in Washington, D.C., to view an exhibit on artist Mark Rothko’s work. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Actor Paul Giamatti sits down with Lesley Stahl to discuss his latest film, “The Holdovers,” as well as other characters he has portrayed throughout his career. Then, Seth Doane travels to the Musée d’Orsay in Paris to learn about the AI-generated avatar of Vincent Van Gogh. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Actor Hilary Swank sits down with Tracy Smith to discuss her latest film, “Ordinary Angels.” Then, Conor Knighton travels to New Orleans to meet portraitist Michael Deas and to learn about his paintings found on stamps, Time magazine covers and more. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

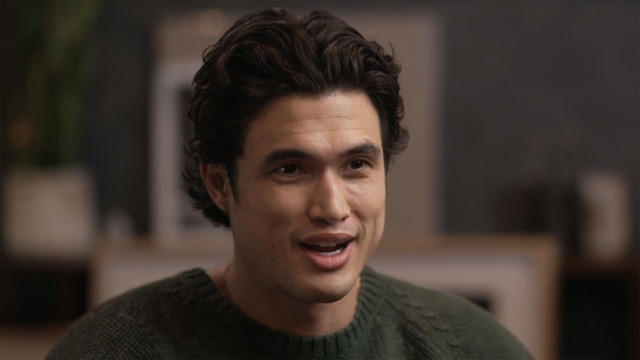

Actor Charles Melton sits down with Tracy Smith to discuss his latest film, “May December.” Then, Conor Knighton travels to Las Vegas to attend The World of Concrete’s annual convention. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Recognized as one of CMT's "Next Women of Country," Tanner Adell's career soared after her appearances on Beyoncé's latest album. With a 1,500% spike in Spotify listeners and a new single, "Whiskey Blues," Adell is quickly becoming a standout in the country-pop scene.

Award-winning author Salman Rushdie describes his new memoir as a "reckoning." In 2022, he was stabbed in the neck and abdomen more than a dozen times in western New York and lost sight in his right eye. In Rushdie's new memoir, "Knife: Meditations After an Attempted Murder," he writes about the attack. He and his wife, poet and author Rachel Eliza Griffiths, join "CBS Mornings" for their first joint live interview.

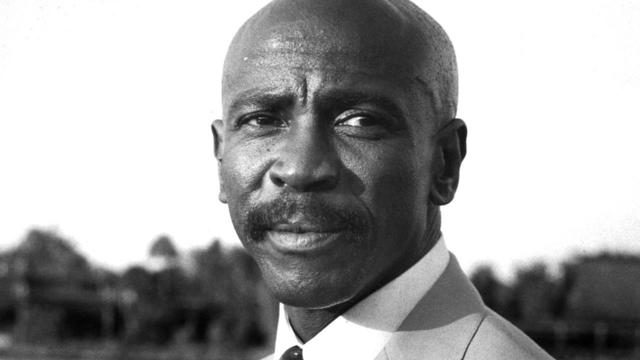

Chicago public school teacher Earnest Horton is the founder of Black Baseball Media, which gives players from predominantly underserved communities access to top-notch facilities and exposure to college scouts. CBS Chicago's Charlie De Mar shares his story on Jackie Robinson Day.

Growing up, Morgan Price said she often felt isolated as one of the few Black gymnasts on her team, a challenge she overcame with the support of her family and, now, her teammates.

In "The Dish," Janet Shamlian visits The Greasy Spoon in Houston, Texas, where traditional Southern comfort dishes get a unique twist.

In this episode of "Person to Person with Norah O’Donnell," O’Donnell speaks with CVS Health CEO and author Karen Lynch about her life and career.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with author and professor Adam Grant about his newest book, as he discusses unlocking your hidden potential.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with author and professor Arthur Brooks about his partnership with Oprah Winfrey and the key to living a happier life.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with Senator Mitt Romney about his place in the Republican party, his family’s influence and what’s next for him in politics.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with Dolly Parton about her new book on her costumes and clothing and her new rock album.

Spencer, the official mascot of the Boston Marathon, is honored by his community. David Begnaud introduces us to a woman who calls herself a "bad weather friend" – because she's there when you need her most. Plus, more heartwarming stories.

Russ Cook says the scariest part of his run through Africa was "on the back of a motorbike, thinking I was about to die."

A trendsetting third grader creates a school tradition to don dapper outfits on Wednesdays. A retiree makes it her mission to thank those who may be in thankless jobs. Plus, more heartwarming and inspiring stories.

Lyn Story is a retiree whose mission is to be the "bad weather friend," someone who is there for you in a time of need. David Begnaud shows how her huge heart led to life-changing friendships.

Nets star Mikal Bridges fulfills his dream of teaching by working at a school in Brooklyn for the day. A doctor overcomes the odds to help other survivors of catastrophic injuries. Plus, behind the scenes of Drew Barrymore's talk show, and more heartwarming stories.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

House Speaker Mike Johnson said Tuesday he won't resign, as another lawmaker calls for him step down or face an effort to remove him from the top post.

ABBA, Blondie and The Notorious B.I.G. are entering America's audio canon.

"Grief has come to us in waves. Moments of feeling absolutely gutted... then moments of feeling blessed by just getting a moment with her," the couple said.

O.J. Simpson's former attorney and the current executor of his estate previously said he hoped the Goldman family would get "zero, nothing."

A whopping 10,000 athletes will carry the torch 3,100 miles over 68 days.

Bayer has been lobbying lawmakers in three states to pass bills providing it legal protection from suits claiming Roundup causes cancer. Experts say such a measure could have much broader implications.

The union for American Airlines pilots says it's been seeing "a significant spike in safety- and maintenance-related problems in our operation."

The housing market continues to be challenging for both buyers and sellers this year, as mortgage rates and asking prices continue to climb

The tax-prep software giant says it has resolved an issue that blocked some customers from e-filing on Sunday and much of Monday.

Nike's unitard for female track and field athletes representing the U.S. at the 2024 Paris Olympics is too revealing, critics say.

House Speaker Mike Johnson said Tuesday he won't resign, as another lawmaker calls for him step down or face an effort to remove him from the top post.

The Supreme Court seemed divided over a case challenging the scope of a federal obstruction law that prosecutors have used to charge more than 300 Jan. 6 defendants.

The Senate is tasked with the trial after the House impeached Mayorkas earlier this year. Senate Democrats are expected to move to quickly quash the effort.

Jury selection in former President Donald Trump's historic criminal trial in New York is continuing for a second day on Tuesday.

President Biden believes painting former President Trump as a "threat" to democracy is a crucial contrast to highlight in his campaign.

"Grief has come to us in waves. Moments of feeling absolutely gutted... then moments of feeling blessed by just getting a moment with her," the couple said.

Bella Hadid raised eyebrows after sharing her elaborate morning routine on TikTok, and other over-the-top celebrity self-care rituals are everywhere. Here's what experts suggest you aim for instead.

Consumer complaints have risen in recent months of unauthorized enrollment in Affordable Care Act coverage.

Social services, such as parenting classes and economic development programs, can help, some health experts say. But insurers don't always cover these services.

George Schappell and sister Lori, of Reading, Pa., were the world's oldest conjoined twins, according to the Guinness Book of World Records.

Normally parched roads and airport runways in the desert city-state of Dubai were left underwater by an incredibly rare rainstorm.

A whopping 10,000 athletes will carry the torch 3,100 miles over 68 days.

A Sudanese-American family is the first to be reunited in the U.S. after a woman and her sons spent nearly a year stuck in Saudi Arabia.

The 17th-century building's iconic spire, thought to protect the building "against enemy attacks and fires," collapsed among the flames.

The House speaker says he wants to put up separate individual bills on aid for Ukraine, Israel, and Taiwan.

Adell remained tight-lipped about her studio time with Beyoncé, urging fans to use their imagination

ABBA, Blondie and The Notorious B.I.G. are entering America's audio canon.

Recognized as one of CMT's "Next Women of Country," Tanner Adell's career soared after her appearances on Beyoncé's latest album. With a 1,500% spike in Spotify listeners and a new single, "Whiskey Blues," Adell is quickly becoming a standout in the country-pop scene.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

This week on CBS’s hit comedy "Ghosts," Rebecca Wisocky returns as the Gilded Age socialite Hetty, revealing surprising details about her character's past.

The Biden administration is awarding Samsung $6.4 billion to expand American chipmaking. The company will spread the money across at least five facilities in Texas. Sujai Shivakumar, senior fellow at the Center for Strategic and International Studies, joins CBS News to assess the economic and technological impacts.

Roku said Friday a second security breach impacted more than 576,000 accounts after announcing in March that 15,000 accounts had been exposed by a hack. Emma Roth, a writer for The Verge, joins CBS News with more details.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

The bill reforms and extends a portion of the Foreign Intelligence Surveillance Act known as Section 702 for a shortened period of two years.

The feature will be turned on by default globally for teens under 18. Adult users will get a notification encouraging them to activate it, Meta said.

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

Only 5 to 6% of plastic waste produced in the U.S. is actually recycled. A new report accuses the plastics industry of a decades-long campaign to "mislead" the public about the viability of recycling.

Mexico City, one of the world's most populated cities with nearly 22 million people, could run out of water in months. Florencia Gonzalez Guerra, an investigative video journalist, joins CBS News to examine the causes behind the crisis.

Greenhouse gas emissions continued increasing in 2023, according to new data from the National Oceanic and Atmospheric Administration. CBS News' Elaine Quijano breaks down the numbers and what they mean for the climate.

The Biden administration awarded $830 million Thursday to fund projects that will address the impact of climate change on America's aging infrastructure. Ali Zaidi, an assistant to the president and national climate adviser, joins CBS News with more on the funding.

Jury selection in former President Donald Trump's historic criminal trial in New York is continuing for a second day on Tuesday.

Hannah Gutierrez-Reed, the "Rust" Western film armorer who last month was found guilty of involuntary manslaughter in the deadly shooting of the film's cinematographer Halyna Hutchins, was sentenced to 18 months in prison for her part in the 2021 incident. CBS News legal contributor Jessica Levinson breaks down the sentencing.

Hannah Gutierrez-Reed, the armorer on Alec Baldwin's film "Rust," was given the maximum sentence of 18 months in prison for involuntary manslaughter.

A teenager has been arrested after a stabbing attack in a church in a Sydney suburb that officials Monday called "a terrorist incident."

Federal authorities are asking for the public's help in tracking down two men seen damaging popular rock formations at the Lake Mead National Recreation Area in Nevada.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

It was a "bittersweet moment" as United Launch Alliance brought the Delta program to a close.

NASA flight engineers managed to photograph and videotape the moon's shadow on Earth about 260 miles below them.

Millions of Americans poured into the solar eclipse’s path of totality to watch in wonder. The excitement was shared across generations for the rare celestial event that saw watch parties across the country as almost all of the continental U.S. saw at least a partial solar eclipse.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

The Justice Department says more than 1,387 people have been charged in connection to the Jan. 6 Capitol riot. CBS News' Anne-Marie Green breaks down the charges.

The Supreme Court is hearing arguments Tuesday over whether a federal obstruction law can be used to prosecute former President Donald Trump and hundreds of Jan. 6 rioters. CBS News congressional correspondent Scott MacFarlane has more.

"This is our Notre Dame": Copenhagen's Old Stock Exchange building, which dates back to the 17th century, erupted into flames in what onlookers could only describe as a tragedy. The iconic building's dragon-tail spire, which legend says protected it from nearby fires for years, collapsed.

House Speaker Mike Johnson said Tuesday he won't resign from his leadership post despite another effort from far-right members of his own party to vacate the speakership.

House Speaker Mike Johnson is moving to help Israel, Ukraine and Taiwan by splitting a foreign aid bill into pieces to bypass some fellow Republicans who object to sending more money to Ukraine. CBS News congressional correspondent Nikole Killion has more.