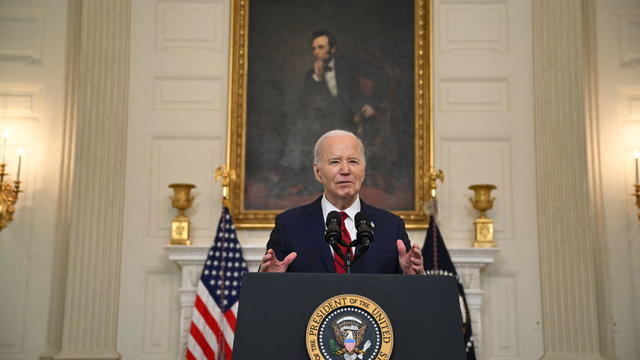

Biden signs foreign aid bill, clearing the way for new weapons for Ukraine

"It's a good day for America, it's a good day for Europe and it's a good day for world peace," Mr. Biden said in remarks from the White House.

Watch CBS News

"It's a good day for America, it's a good day for Europe and it's a good day for world peace," Mr. Biden said in remarks from the White House.

A video released by Hamas' military wing appears to show U.S.-Israeli hostage Hersh Goldberg-Polin delivering a message under duress.

Earlier this month, the Arizona Supreme Court ruled that the highly-restrictive 160-year-old law that bans nearly all abortions can be enforced.

The New Jersey Democrat suffered "a cardiac episode based on complications from his diabetes" earlier this month.

The outcome of the immunity case before the Supreme Court will have significant ramifications for former President Donald Trump's federal criminal prosecution in Washington, D.C.

Lawmakers argue the Chinese government can use the widely popular video-sharing app as a spy tool and to covertly influence the U.S. public.

Expanded federal overtime rule could result in employers paying workers an additional $1.5 billion, according to one estimate.

The USDA had floated banning flavored milk options from some school lunches.

"America is a nation founded on the promise of second chances," President Biden said in a statement.

For the first time, surgeons at NYU Langone Health performed a combined mechanical heart pump and gene-edited pig kidney transplant into a living person.

Lisa Ling is a CBS News contributor and part of the sandwich generation herself. Ling's family is part of nearly 80 million Americans taking care of children and our elderly parents at the same time.

Rapper Toomaj Salehi has been jailed for more than a year and a half for his support of protests after Mahsa Amini's death, according to local media.

The former star USC running back's name is back on the Heisman Winners Archive list, and Bush will be part of all future Heisman Trophy ceremonies, starting with the 90th Heisman Trophy ceremony this fall.

A person magnet fishing in Horse Creek found a .22-caliber rifle, a cellphone, driver's licenses and credit cards, authorities said.

Glenn Sullivan Sr., 54, pleaded guilty to four counts of second-degree rape on April 17.

Richard Ehrhart was hiking the Natural Bridges coastal trail when he fell, authorities said.

Travelers often spend more than they need to for airfare, experts say. Here's what to know about paying for add-ons like your seat assignment.

Authorities are offering a $20,000 reward for information that aids their investigation into a dolphin found shot dead in Louisiana.

There are no cameras allowed in the court where Trump is being tried on 34 felony counts stemming from a "hush money" payment before the 2016 election.

Jurors in former President Donald Trump's trial in New York heard testimony from a former media executive about his efforts to bury negative stories about Trump before the 2016 presidential election.

Trump made 10 social media posts that were "threatening, inflammatory," prosecutors said, arguing he should pay a fine for each post.

The FBI calls on tech companies to "step up" to protect people looking for love online.

Scammers have been increasingly successful in leveraging their romantic grip on victims.

Laura Kowal's match on a dating site wasn't what he seemed. Now her daughter wants to expose the risk of romance scams.

Summer Lee has defeated Bhavini Patel in the Democratic primary for Pennsylvania's 12th Congressional District, the Associated Press projects.

He could receive a large windfall from his newly public media company, Trump Media & Technology Group.

Protesters have been arrested at Columbia and Yale as they've called for a break from Israel.

Columbia University has given students 48 hours to dismantle their pro-Palestinian protest on the school's main lawn.

The Netzah Yehuda Battalion of the Israel Defense Forces has faced criticism for its conduct. Will the U.S. take action?

A tiny baby rescued from the womb after an Israeli airstrike in Gaza killed her mother is doing well.

There are a few reasons why you may want to put some money in gold before the Fed meets again. Here's what to know.

Mortgage points can help homebuyers significantly reduce their monthly mortgage payments. Here's how.

Though long-term care insurance may be available in your 80s, you shouldn't wait to apply. Here's why.

Expanded federal overtime rule could result in employers paying workers an additional $1.5 billion, according to one estimate.

Travelers often spend more than they need to for airfare, experts say. Here's what to know about paying for add-ons like your seat assignment.

Regulators prohibit new noncompetes, which impede millions of U.S. workers from getting a better job.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

Receive a $40 Digital Costco Shop Card when you join as a new member at Costco.com when entering PARA24 at checkout.

From kid-sized carry-ons to super-sized family luggage, invest in these suitcases for your next family vacation.

The postseason is on: We found the easiest (and cheapest) ways to catch the NBA Playoffs this year.

More than 89,000 Americans are waiting for a donor kidney. Recently, a New Jersey patient became the first woman and second living human to receive a kidney transplant from a pig.

Next time you have trouble with your flight, you could be entitled to a cash refund. New rules from the U.S. Department of Transportation cover canceled flights and delays meeting certain requirements if you choose not to fly, along with specific fees.

Dating companies say protecting their customers is a top priority but critics want them to do more to curb online scams and stop bad actors in their tracks, law enforcement officials and online security experts say. CBS News asks the CEO of Match Group — one of the biggest players in the online dating space — about customers who have lost everything.

Less than two years after the overturn of Roe v. Wade, the Supreme Court is set to hear a high profile case Wednesday on Idaho’s near-total abortion ban that some doctors say is putting pregnant women at risk.

In this episode of "Person to Person with Norah O’Donnell," O’Donnell speaks with CVS Health CEO and author Karen Lynch about her life and career.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with author and professor Adam Grant about his newest book, as he discusses unlocking your hidden potential.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with author and professor Arthur Brooks about his partnership with Oprah Winfrey and the key to living a happier life.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with Senator Mitt Romney about his place in the Republican party, his family’s influence and what’s next for him in politics.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with Dolly Parton about her new book on her costumes and clothing and her new rock album.

Deesha Dyer, a former hip-hop journalist and community college student from Philadelphia, shares her inspiring path to becoming the White House social secretary under former President Barack Obama. Her new book, "Undiplomatic: How My Attitude Created the Best Kind of Trouble," details her rise from a 2009 internship to managing state dinners concerts, and high-profile visits, including from the pope.

This will be the first General Conference since more than 7,600 mostly conservative congregations left the United Methodist Church between 2019 and 2023.

At least 77 students from the women-only college at Cambridge University were recruited to the code breaking station during World War II.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

Emmy and Tony Award-winning actress Bebe Neuwirth is back on Broadway, starring as Fraulein Schneider in the new revival of "Cabaret."

In California, we dine out at a restaurant powered by robots. Then in Washington, we take a sip of a beanless cup of coffee, which aims to reduce the environmental impact of the popular beverage. Watch these stories and more on "Eye on America" with host Michelle Miller.

In New York, we tour a unique museum that’s home to an extensive collection of toys, games and playgrounds. Then, we sit down with NBA superstar Steph Curry to discuss his heartwarming new children’s book. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Arizona, we learn why flag football is becoming an increasingly popular sport, especially among girls. Then in New York, we meet with descendants of some of the most notable suffragists of the 20th century. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Connecticut, we meet the preservationists who are giving dilapidated lighthouses new life. Then in California, we learn about the efforts to restore an iconic fishing boat. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Louisiana, we learn how a devastating drought has greatly diminished the area’s crawfish supply. Then in Ohio, we tour a small business that’s seeing promising results from a four-day work week model. Watch these stories and more on Eye on America with host Michelle Miller.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

A surfing accident left New York teacher Billy Keenan paralyzed, but when he received a call from a police officer, his life changed.

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

A mom was worried about what her son, who has autism, would do after high school. So she opened the So Much To Give cafe, a restaurant in Cedars, Pennsylvania, that employs people with disabilities – and helps them grow.

David Begnaud visits Jeffrey Olsen, known as the "Toy Man" in Vista, California, who has dedicated over 30 years to donating toys, food, and clothes to those in need.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

The New Jersey Democrat suffered "a cardiac episode based on complications from his diabetes" earlier this month.

Lisa Ling is a CBS News contributor and part of the sandwich generation herself. Ling's family is part of nearly 80 million Americans taking care of children and our elderly parents at the same time.

For the first time, surgeons at NYU Langone Health performed a combined mechanical heart pump and gene-edited pig kidney transplant into a living person.

"It's a good day for America, it's a good day for Europe and it's a good day for world peace," Mr. Biden said in remarks from the White House.

"America is a nation founded on the promise of second chances," President Biden said in a statement.

Lawmakers argue the Chinese government can use the widely popular video-sharing app as a spy tool and to covertly influence the U.S. public.

Expanded federal overtime rule could result in employers paying workers an additional $1.5 billion, according to one estimate.

Travelers often spend more than they need to for airfare, experts say. Here's what to know about paying for add-ons like your seat assignment.

Tesla reports slide in earnings and revenue, but investors cheered by pledge to accelerate rollout of cheaper vehicles.

Regulators prohibit new noncompetes, which impede millions of U.S. workers from getting a better job.

The New Jersey Democrat suffered "a cardiac episode based on complications from his diabetes" earlier this month.

"It's a good day for America, it's a good day for Europe and it's a good day for world peace," Mr. Biden said in remarks from the White House.

"America is a nation founded on the promise of second chances," President Biden said in a statement.

The outcome of the immunity case before the Supreme Court will have significant ramifications for former President Donald Trump's federal criminal prosecution in Washington, D.C.

The USDA had floated banning flavored milk options from some school lunches.

For the first time, surgeons at NYU Langone Health performed a combined mechanical heart pump and gene-edited pig kidney transplant into a living person.

The USDA had floated banning flavored milk options from some school lunches.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Warmer weather is prime time for ticks that can carry Lyme disease and other illnesses. Here's how to spot them and get rid of them.

Tires emit huge volumes of particles and chemicals as they roll along the highway, and researchers are only beginning to understand the threat. One byproduct of tire use, 6PPD-q, is in regulators' crosshairs after it was found to be killing fish.

A video released by Hamas' military wing appears to show U.S.-Israeli hostage Hersh Goldberg-Polin delivering a message under duress.

Rapper Toomaj Salehi has been jailed for more than a year and a half for his support of protests after Mahsa Amini's death, according to local media.

Ukraine claims to have destroyed almost 1 million cubic feet of fuel in a drone strike on Russian state-owned oil depots.

A priest who oversaw a memorial for late Russian opposition leader Alexey Navalny has been suspended by the head of the country's Orthodox Church.

Two runaway military horses bolted through central London, leaving at least 4 people and the animals injured, officials said.

Country music star Blake Shelton expands his popular bar and music venue 'Ole Red' from Nashville to Las Vegas. This opening coincides with Shelton stepping back from his prominent TV roles.

Surprise guests, a broken foot and a history-making headliner.

Eric Church is revered as one of country music's most respected figures, often described as Nashville's renegade. But he admits that even after his success, he sometimes still sees himself as an outsider.

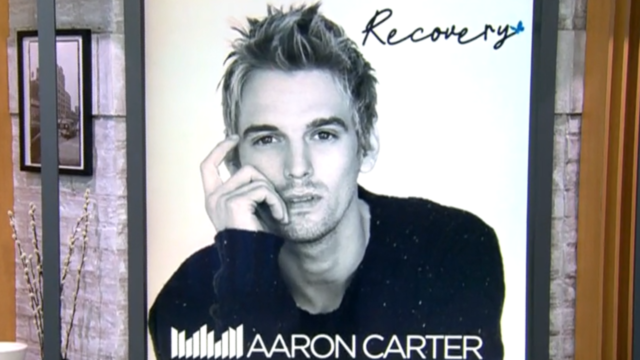

Angel Carter Conrad talks about her brother Aaron Carter, his death and how she hopes his legacy and previously unheard music can help others.

Emmy and Tony Award-winning actress Bebe Neuwirth is back on Broadway, starring as Fraulein Schneider in the new revival of "Cabaret."

Lawmakers argue the Chinese government can use the widely popular video-sharing app as a spy tool and to covertly influence the U.S. public.

NASA's Voyager 1, the first spacecraft to travel beyond our solar system, has started sending information back to Earth again after scientists managed to fix the probe from 15 billion miles away.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

Customers who rely on government assistance programs can get same perks as Prime members, for less.

Secretary of Commerce Gina Raimondo is at the center of a global competition for semiconductor dominance. It's a battle that also puts her at the center of two of the hottest global national security hotspots. Lesley Stahl of 60 Minutes spoke with Raimondo for the broadcast.

The White House is considering declaring a national climate emergency to unlock federal powers and stifle oil development, according to a Bloomberg report. Meanwhile, the Biden administration is announcing several projects this Earth Week. Columbia University Climate School professor Dr. Melissa Lott joins with analysis.

NASA's Voyager 1, the first spacecraft to travel beyond our solar system, has started sending information back to Earth again after scientists managed to fix the probe from 15 billion miles away.

Relatively few Americans say they know a lot about President Biden's initiatives to combat climate change, according to a CBS News poll. Carolyn Kissane, a New York University global affairs associate dean and professor, joins CBS News with more on Biden's climate policies.

A photo taken two days after the sinking of the RMS Titanic apparently shows the iceberg that doomed the so-called unsinkable ship in 1912. CBS News' John Dickerson has details.

Despite how terrifying sharks might seem, the creatures are critical to the survival of the world's oceans. Oceans generate 50% of the oxygen on the planet and absorb 90% of excess heat created by global warming. CBS News senior national and environmental correspondent Ben Tracy spoke with conservationists in the Bahamas.

Glenn Sullivan Sr., 54, pleaded guilty to four counts of second-degree rape on April 17.

A person magnet fishing in Horse Creek found a .22-caliber rifle, a cellphone, driver's licenses and credit cards, authorities said.

CBS News is investigating a growing number of fraud cases known as romance scams. Chief investigative correspondent Jim Axelrod explains how victims can unknowingly become perpetrators in the very scams they fall prey to.

Jim Axelrod dives into the world of romance scams, showing how sometimes the victims can also become unwitting accomplices in the scammers' financial crimes.

Don Steven McDougal, a family friend, was indicted by a Polk County grand jury in connection with the death of an 11-year-old girl.

In November 2023, NASA's Voyager 1 spacecraft stopped sending "readable science and engineering data."

In two weeks, Boeing's Starliner spacecraft is scheduled to launch its first piloted test flight, bringing two veteran NASA astronauts to the International Space Station. Astronaut Matt Dominick joined CBS News from the ISS to talk about the mission and life in space.

A process called cryopreservation allows cells to remain frozen but alive for hundreds of years. For some animal cells, the moon is the closest place that's cold enough.

The Lyrid meteor show is set to peak as the week begins.

April's full moon, known as the Pink Moon, will reach peak illumination on Tuesday, but it will appear full from Monday morning through Thursday morning.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

The British Parliament passed a law that allows authorities to put any asylum-seekers arriving in the U.K. without prior permission on a plane and send them to Rwanda. The law is intended to act as a deterrent to anyone trying to enter the U.K. illegally. CBS News foreign correspondent Ramy Inocencio breaks down what you need to know about the controversial program.

President Biden spoke from the White House Wednesday after signing into law a $95 billion foreign aid package that will send money to Israel, Ukraine and Taiwan. The president had been pushing Congress on the legislation for months. CBS News chief White House correspondent Nancy Cordes had analysis of Mr. Biden's remarks following his address.

Condé Nast Traveler's annual Hot List is here. Executive editor Erin Florio joined CBS News for an exclusive first look at the diverse range of hotels, restaurants and cruises that made the cut.

Two military horses, including one seemingly covered in blood, went on the loose through the streets of central London and injured at least four people.

Secretary of State Antony Blinken is in China this week for critical talks. The Middle East, the war in Ukraine, Taiwan, human rights issues and TikTok are all expected to be on the agenda. CBS News contributor Isaac Stone Fish has a look at where the U.S.-China relationship stands right now.