Trump trial moves to cross-examination of first witness

Former National Enquirer publisher David Pecker will field questions from the former president's defense team.

Watch CBS News

Former National Enquirer publisher David Pecker will field questions from the former president's defense team.

Hundreds of people have been arrested in California, New York, Massachusetts, Texas, Georgia and other states during the tense protests on college campuses.

After meeting China's leader Xi Jinping, Antony Blinken says both sides agree that difficult discussions are essential to avoid "any miscalculations."

The case fueled social media speculation about whether his disappearance had been tied to his cryptocurrency dealings.

President Biden finds familiar and active allies for his reelection bid with labor union endorsements.

An Black Ohio man, Frank Tyson, seen handcuffed and facedown on a bar floor in body cam video died in police custody, and the officers involved have been placed on paid administrative leave.

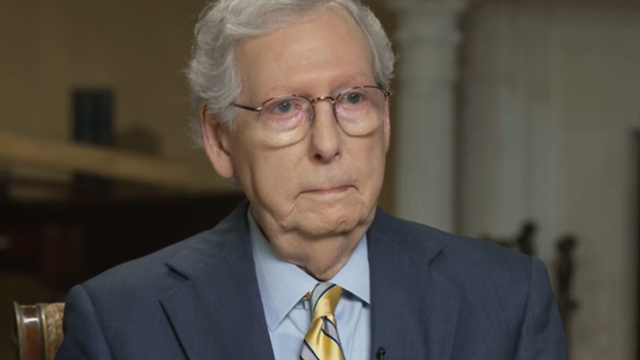

Senate Minority Leader Mitch McConnell appears on "Face the Nation" as pro-Palestinian protests roil American politics.

Ryan Watson, who faces a possible 12-year prison sentence after ammo was allegedly found in his carry-on, said he feels " incredibly blessed that people have been responding in such a powerful way."

A former high school athletic director was arrested Thursday morning after allegedly using artificial intelligence to impersonate the school principal in a recording that included racist and antisemitic comments.

An unprecedented six of the first 12 picks were quarterbacks, an NFL Draft record.

Are you using your smartwatch to the fullest? Here are 4 metrics doctors say can be useful to track beyond your daily step count.

Astronauts Barry Wilmore and Sunita Williams say they have complete confidence in the Starliner despite questions about Boeing's safety culture.

It's been a decade since the Flint water crisis began. Residents told CBS News the scandal still weighs heavily on the city.

David Schultz's wife said that the person found was wearing boots that matched her husband's, and his keys were found in the pants pocket.

A cross unearthed in eastern Poland likely belonged to an outcasted Russian religious community around 300 years ago.

The median mortgage payment jumped to a record $2,843 in April, up nearly 13% from a year ago, a new analysis finds.

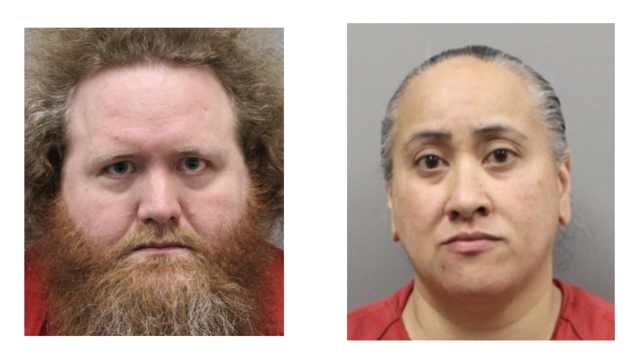

Henderson police said they found the boy wearing a diaper in the feces-smeared enclosure.

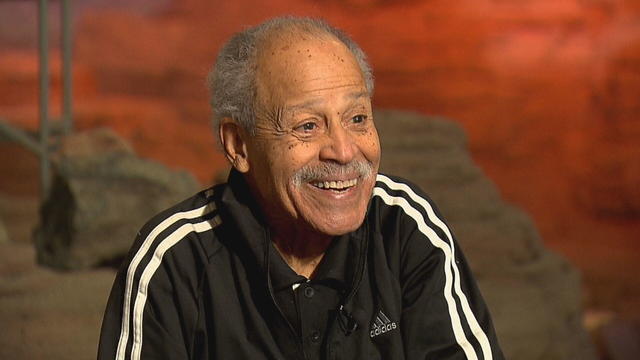

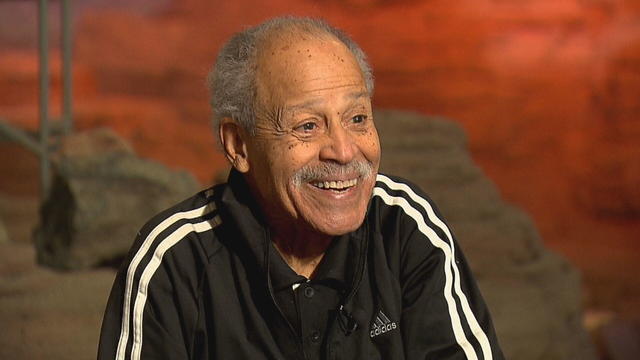

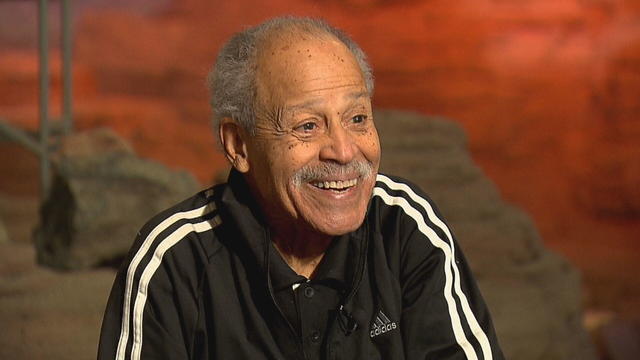

In 1961, Ed Dwight was selected by President John F. Kennedy to enter an Air Force training program known as the path to NASA's Astronaut Corps. But he ultimately never made it to space.

There are no cameras allowed in the court where he's being tried.

A former media executive testified about his efforts to bury negative stories about Trump before the 2016 election.

A federal judge rebuffed his request for a new trial in the civil suit that ended with an $83.3 million judgment for her.

The FBI calls on tech companies to "step up" to protect people looking for love online.

Laura Kowal's match on an online dating site wasn't what he seemed. Now her daughter wants to expose the risk of such scams.

Scammers have been increasingly successful in leveraging their romantic grip on victims.

Summer Lee defeated Bhavini Patel in a Pittsburgh-area district, the Associated Press projected.

He could receive a large windfall from his newly public media company, Trump Media & Technology Group.

Protesters have been arrested at Columbia and Yale as they've called for a break from Israel.

Israel's leader equated U.S. university protests to rallies in Nazi Germany.

Mike Johnson was booed loudly as he visited the school, where he joined calls for its president to resign.

The video appears to show U.S.-Israeli hostage Hersh Goldberg-Polin delivering a message under duress.

Do you have $7,500 or more in credit card debt? Here are a few ways to pay it off quickly.

Looking to make a successful investment in gold? Then be sure to avoid making these simple mistakes.

You don't have to accept a low interest rate on your savings. There are many great account options to consider.

The median mortgage payment jumped to a record $2,843 in April, up nearly 13% from a year ago, a new analysis finds.

Visitors will have to pay five euros, a fee designed to offset some of the costs of accommodating tourists.

President Joe Biden has signed legislation that could lead to TikTok being sold or banned. Here's who might buy it — and for how much.

These are the airports Southwest is pulling out of completely as it looks to save costs.

Only one vehicle of the 10 small SUVs tested earned a good rating.

Receive a $40 Digital Costco Shop Card when you join as a new member at Costco.com when entering PARA24 at checkout.

Find out how and when to watch Game 3 of the Milwaukee Bucks vs. Indiana Pacers NBA Playoffs series tonight.

Using one of the best outdoor projector is the perfect way to host a movie night for friends and family.

The Supreme Court on Thursday heard three hours of arguments over whether former President Donald Trump should be immune from criminal prosecution for official acts he took while in office. A decision, which is not expected until June, will have ramifications on the federal case that accuses Trump of attempting to overturn the results of the 2020 election. Jan Crawford has details.

David Pecker, former publisher of the National Enquirer, took the stand Thursday for the third day in former President Donald Trump's "hush money" trial in Manhattan. Pecker told the jury that he declined to purchase Stormy Daniels' story himself, but he advised then-Trump attorney Michael Cohen "to buy this story and take it off the market." Robert Costa reports.

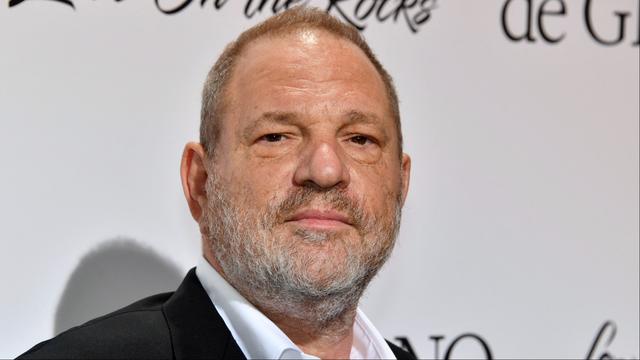

The New York State Court of Appeals ruled Thursday that disgraced former media mogul Harvey Weinstein did not receive a fair trial in a 2020 case in which he was found guilty of sexually assaulting two women. In a 4-3 decision, the appeals court determined that the judge in the case "erroneously" admitted testimony from women whose claims were not part of the charges. Jericka Duncan has more on the decision and what could come next.

The Supreme Court on Thursday heard three hours of arguments over whether former President Donald Trump should be immune from criminal prosecution for official acts he took while in office. A decision, which is not expected until June, will have ramifications on the federal case that accuses Trump of attempting to overturn the results of the 2020 election. Jan Crawford has details.

David Pecker, former publisher of the National Enquirer, took the stand Thursday for the third day in former President Donald Trump's "hush money" trial in Manhattan. Pecker told the jury that he declined to purchase Stormy Daniels' story himself, but he advised then-Trump attorney Michael Cohen "to buy this story and take it off the market." Robert Costa reports.

The New York State Court of Appeals ruled Thursday that disgraced former media mogul Harvey Weinstein did not receive a fair trial in a 2020 case in which he was found guilty of sexually assaulting two women. In a 4-3 decision, the appeals court determined that the judge in the case "erroneously" admitted testimony from women whose claims were not part of the charges. Jericka Duncan has more on the decision and what could come next.

The mother of Hersh Goldberg-Polin, an Israeli-American man who was taken hostage by Hamas militants in their Oct. 7 assault on Israel, spoke to CBS News Thursday about a video released Wednesday by Hamas that appears to show her son in captivity. Debora Patta has more.

It's been a decade since the Flint water crisis began. Residents told CBS News the scandal still weighs heavily on the city.

In 1961, Ed Dwight was selected by President John F. Kennedy to enter an Air Force training program known as the path to NASA's Astronaut Corps. But he ultimately never made it to space.

In an exclusive interview with "CBS Evening News" anchor and managing editor Norah O’Donnell, Pope Francis discusses the wars in Ukraine and Gaza and calls for negotiating peace.

President Biden and his reelection campaign clearly state they need Latino support this November. However, several polls in recent months have revealed an increasing number of Latino voters preferring former President Donald Trump. CBS News political director Fin Gómez and Democratic strategist Chuck Rocha join to discuss more.

"CBS Evening News" anchor and managing editor Norah O'Donnell was given a private tour of the magnificent St. Peter's Basilica, the largest church in the world, located in the smallest nation in the world.

Jet fuel from a Navy facility leaked into the water system, contaminating the drinking water for thousands of military families. Families say they are dealing with ongoing health issues and are suing the government. Sunday.

One of only five companies to ever surpass $2 trillion in stock market value, computer chip maker Nvidia ushered in the artificial intelligence revolution with its groundbreaking software and graphics processing unit. Bill Whitaker reports, Sunday.

60 Minutes traveled to Madagascar in 2012 to report on efforts being made to save endangered turtles and tortoises, including the plowshare tortoise, a species that remains at risk of extinction due to poaching for the illegal pet trade.

Heaven Hart told 60 Minutes correspondent Anderson Cooper that she had to speak up about jokes that revealed her private life onstage.

Last year, 60 Minutes reported that scientists were sounding an alarm that we were living in the midst of the sixth mass extinction. Biologist Paul Ehrlich told Scott Pelley that humans would need "five more Earths" to maintain our current way of life.

In 1961, Ed Dwight was selected by President John F. Kennedy to enter an Air Force training program known as the path to NASA's Astronaut Corps. But he ultimately never made it to space.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

A surfing accident left New York teacher Billy Keenan paralyzed, but when he received a call from a police officer, his life changed.

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

A mom was worried about what her son, who has autism, would do after high school. So she opened the So Much To Give cafe, a restaurant in Cedars, Pennsylvania, that employs people with disabilities – and helps them grow.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

The case fueled social media speculation about whether his disappearance had been tied to his cryptocurrency dealings.

Former National Enquirer publisher David Pecker will field questions from former President Donald Trump's defense team.

A Black Ohio man, Frank Tyson, seen handcuffed and facedown on a bar floor in body cam video died in police custody, and the officers involved have been placed on paid administrative leave.

It's been a decade since the Flint water crisis began. Residents told CBS News the scandal still weighs heavily on the city.

An unprecedented six of the first 12 picks were quarterbacks, an NFL Draft record.

Some 46.8% of luxury homes were bought entirely with cash in the three months ended February 29, the highest share in a decade, according to Redfin.

The median mortgage payment jumped to a record $2,843 in April, up nearly 13% from a year ago, a new analysis finds.

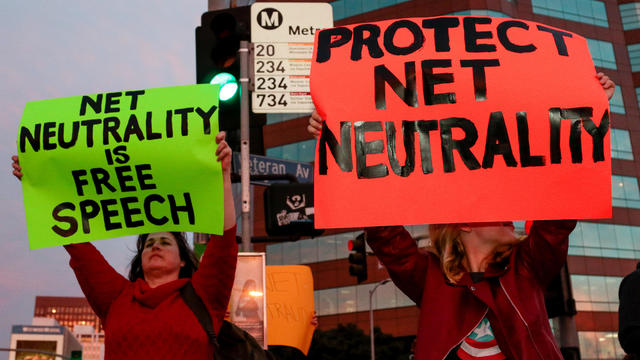

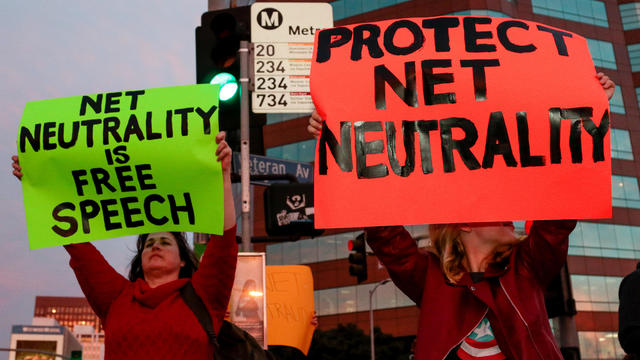

U.S. regulators are reviving a rescinded rule, laying the groundwork for for a major court fight with the broadband industry.

Visitors will have to pay five euros, a fee designed to offset some of the costs of accommodating tourists.

PayPal payments are being made to 117,044 consumers whose videos may have been accessed by unauthorized users.

After meeting China's leader Xi Jinping, Antony Blinken says both sides agree that difficult discussions are essential to avoid "any miscalculations."

Former National Enquirer publisher David Pecker will field questions from former President Donald Trump's defense team.

President Biden finds familiar and active allies for his reelection bid with labor union endorsements.

Former National Enquirer boss David Pecker appeared on the stand for the third day, detailing an agreement the tabloid made with a former Playboy model.

Senate Minority Leader Mitch McConnell appears on "Face the Nation" as pro-Palestinian protests roil American politics.

Are you using your smartwatch to the fullest? Here are 4 metrics doctors say can be useful to track beyond your daily step count.

CDC's provisional figures show a 2% decline in births from 2022 to 2023.

Don't brush your teeth after breakfast? Or after vomiting? Dentists say it can wear away your enamel. Here's what to do instead.

Federal officials say they're double checking whether pasteurization has eradicated the danger from possible bird virus particles in milk.

For the first time, surgeons at NYU Langone Health performed a combined mechanical heart pump and gene-edited pig kidney transplant into a living person.

After meeting China's leader Xi Jinping, Antony Blinken says both sides agree that difficult discussions are essential to avoid "any miscalculations."

Ryan Watson, who faces a possible 12-year prison sentence after ammo was allegedly found in his carry-on, said he feels " incredibly blessed that people have been responding in such a powerful way."

The petitions are the latest in the effort for Ryan Corbett's release.

A cross unearthed in eastern Poland likely belonged to an outcasted Russian religious community around 300 years ago.

Hundreds of people have been arrested in California, New York, Massachusetts, Texas, Georgia and other states during the tense protests on college campuses.

Looking for a place to live in NYC? Zillow is now listing Frank Sinatra and Mia Farrow's former home on the Upper East Side.

Italy's Culture Ministry has banned loans of works to the Minneapolis Institute of Art, following a dispute with the U.S. museum over an ancient marble statue believed to have been looted from Italy almost a half-century ago.

The renowned Moulin Rouge cabaret venue's director has vowed to "rise to the challenge" after the windmill's sails fell off.

Harvey Weinstein's 2020 conviction on felony sex crime charges has been overturned by the State of New York Court of Appeals.

Taylor Swift fans have found a way to feel "a little bit closer to" their hero at a London watering hole, and The Black Dog pub is lapping it up.

Are you using your smartwatch to the fullest? Here are 4 metrics doctors say can be useful to track beyond your daily step count.

Local and federal authorities face challenges in investigating and prosecuting romance scammers because the scammers are often based overseas. Jim Axelrod explains.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

U.S. regulators are reviving a rescinded rule, laying the groundwork for for a major court fight with the broadband industry.

Meta began rolling out its new AI-powered smart assistant software, saying it will be integrated across Instagram, Facebook and Messenger. Adam Auriemma, editor-in-chief for CNET, joined CBS News to discuss the new tool.

Pediatrician Dr. Mona Hanna-Attisha, whose work has spurred official action on the Flint water crisis, told CBS News that it's stunning that "we continue to use the bodies of our kids as detectors of environmental contamination." She discusses ways to support victims of the water crisis, the ongoing work of replacing the city's pipes and more in this extended interview.

Ten years ago, a water crisis began when Flint, Michigan, switched to the Flint River for its municipal water supply. The more corrosive water was not treated properly, allowing lead from pipes to leach into many homes. CBS News correspondent Ash-har Quraishi spoke with residents about what the past decade has been like.

According to the University of California, Davis, residential energy use is responsible for 20% of total greenhouse gas emissions in the U.S. However, one company is helping residential buildings reduce their impact and putting carbon to use. CBS News' Bradley Blackburn shows how the process works.

Emerging cicadas are so loud in one South Carolina county that residents are calling the sheriff's office asking why they can hear a "noise in the air that sounds like a siren, or a whine, or a roar." CBS News' John Dickerson has details.

Representatives from across the world are gathering in Ottawa, Canada, to negotiate a potential treaty to limit plastic pollution. CBS News national environmental correspondent David Schechter has the latest on the talks.

The State of New York Court of Appeals overturned Harvey Weinstein's 2020 rape conviction Thursday and has ordered a new trial. Julie Rendelman, a criminal defense attorney, and CBS News national correspondent Jericka Duncan look at the possible reasons why it was overturned and what it means for Weinstein, who was also convicted of rape in Los Angeles in 2022.

A New York appeals court overturned Harvey Weinstein's 2020 conviction on felony sex crimes. The court ruled that the disgraced movie mogul did not have a fair trial because the judge who presided over the case allowed women to testify about allegations that were not part of the charges against him. Weinstein will remain in prison because of his rape conviction in Los Angeles.

Harvey Weinstein's 2020 conviction on felony sex crime charges has been overturned by the State of New York Court of Appeals.

A former high school athletic director was arrested Thursday morning after allegedly using artificial intelligence to impersonate the school principal in a recording that included racist and antisemitic comments.

William Ray Grimes was indicted on charges of murder and burglary in the 2012 slaying of Lowell Badger, police said.

Astronauts Barry Wilmore and Sunita Williams say they have complete confidence in the Starliner despite questions about Boeing's safety culture.

In 1961, Ed Dwight was selected by President John F. Kennedy to enter an Air Force training program known as the path to NASA's Astronaut Corps. But he ultimately never made it to space.

The creepy patterns were observed by the European Space Agency's ExoMars Trace Gas Orbiter.

The Shenzhou 18 crew will replace three taikonauts aboard the Chinese space station who are wrapping up a six-month stay.

In November 2023, NASA's Voyager 1 spacecraft stopped sending "readable science and engineering data."

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

Pediatrician Dr. Mona Hanna-Attisha, whose work has spurred official action on the Flint water crisis, told CBS News that it's stunning that "we continue to use the bodies of our kids as detectors of environmental contamination." She discusses ways to support victims of the water crisis, the ongoing work of replacing the city's pipes and more in this extended interview.

It's been nearly 35 years since the Cold War ended, but the author of a new book argues not only is the U.S. facing a new Cold War -- it's facing more than one. David Sanger, author of "New Cold Wars," joins CBS News to explain.

Ten years ago, a water crisis began when Flint, Michigan, switched to the Flint River for its municipal water supply. The more corrosive water was not treated properly, allowing lead from pipes to leach into many homes. CBS News correspondent Ash-har Quraishi spoke with residents about what the past decade has been like.

Mari Copeny, widely known as "Little Miss Flint," brought national attention to the Flint water crisis when she met then-President Barack Obama in 2016 at just 8 years old. She tells CBS News about her continued fight for clean drinking water in this extended interview.

Israel is intensifying its strikes on Rafah ahead of a possible ground offensive. Debora Patta reports on the destruction from the war in the territory and tells the story of an aid worker risking it all to help others.