Still no deal in truce talks as Israel downplays chances of ending war

An adviser to Israeli Prime Minister Benjamin Netanyahu told CBS News that "the end of the war will come with the end of Hamas in Gaza."

Watch CBS News

An adviser to Israeli Prime Minister Benjamin Netanyahu told CBS News that "the end of the war will come with the end of Hamas in Gaza."

The U.S. Coast Guard said they had medevaced an hours-old baby from Cleveland, Texas, amid the floodwaters.

Protesters chanted anti-war messages and waved Palestinian flags and Israeli flags during the University of Michigan's commencement Saturday.

Police say multiple bomb threats were reported against synagogues across New York City on Saturday.

Australian brothers Jake and Callum Robinson and their American friend have not been seen since April 27.

The painter, sculptor and printmaker created work that was hailed as landmarks of the minimalist and post-painterly abstraction art movements.

Brian Fanion says he and his wife Amy Fanion had been arguing about his retirement plans when she picked up his service weapon and shot herself. Investigators did not believe his story.

Police in Wisconsin fatally shot a student who had pointed a pellet rifle in their direction outside a middle school, according to the state's Department of Justice.

Federal prosecutors said the men used fake badges, police lights and firearms to rob and kidnap Shamari Taylor for drug money.

It was just the 10th Kentucky Derby decided by a nose, and the first since Grindstone wore the garland of red roses in 1996.

The 2024 Met Gala theme is "The Garden of Time" — to go along with the spring exhibition, titled "Sleeping Beauties: Reawakening Fashion."

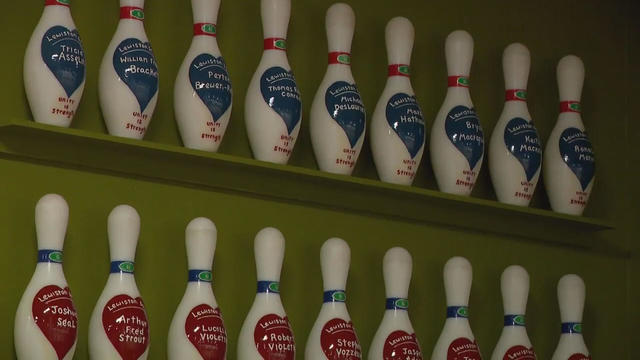

A Lewiston, Maine bowling alley, where eight people were killed during the state's deadliest mass shooting last October, reopened Friday.

Oscar-winning actor Kevin Spacey fired back at fresh allegations of sexual harassment and assault from men who will feature as part of a documentary on British television.

Sadiq Khan, the Labour Party's mayor of London, has romped to victory, securing a record third straight term at City Hall, on another hugely disappointing day for the U.K.'s governing Conservatives ahead of a looming general election.

Hope Hicks, one of former President Donald Trump's closest aides for years, told jurors how she handled the fallout from "hush money" payments made to two women before the 2016 election.

Lawyers from Manhattan DA Alvin Bragg's office told the judge Trump had violated the gag order four more times.

She sent a letter to the Justice Department's Office of Professional Responsibility calling on it to open the investigation.

The GOP candidate with the most votes in the primary said she's suspending her campaign.

The ad features part of Donald Trump's interview with Time Magazine.

Several New York Democrats acknowledged that Republicans are more aggressively counterpunching on the issue.

The U.N. is warning that an Israeli offensive in Rafah would put hundreds of thousands of Palestinians "at imminent risk of death."

The hostage and cease-fire talks have taken on new urgency amid a looming Israeli ground invasion of Rafah, in southern Gaza.

They're spreading far beyond the U.S.

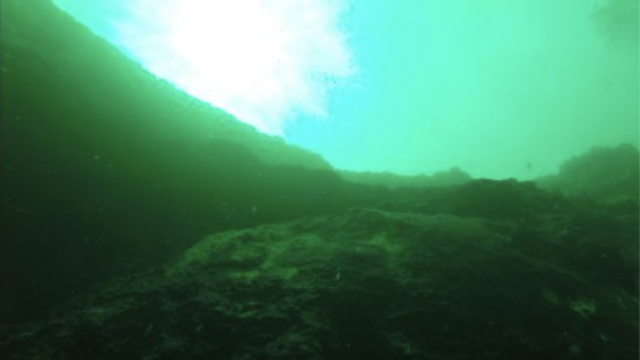

Blue holes are considered an "oasis" for marine life — but the Taam Ja' Blue Hole off the coast of Mexico remains largely mysterious.

Much of Asia is sweltering under a heat wave that one expert calls "by far the most extreme event in world climatic history."

Nine-year-old Kelvin Ellis Jr. had just received the dollar for good grades, and it was the only money he had to his name.

It may be a good idea to invest in gold this May. But, you should consider these pros and cons before you do.

There's a compelling case to be made for choosing a high-yield savings account over a CD this season.

Are you thinking about paying your mortgage off with your home equity? Here are pros and cons to consider first.

Audit firm BF Borgers allegedly failed to comply with accounting standards and fabricated audit documentation, regulators claim.

Job site Indeed identified the top 10 most sought-after job candidates by employers and recruiters. Here's what they found.

U.S. unemployment rate rose slightly to 3.9% in April, continuing a stretch of remaining under 4% for 27 months.

A lawsuit says if emergency responders had known about widespread cellphone outages during the deadly Maui wildfires, they would've used other methods to warn about the disaster.

The IRS is tapping Inflation Reduction Act funding to hire more agents and go after more tax cheats. Here's where it is focusing.

Surprise Mom with cookware, home goods, patio furniture, and much more with our curated picks this holiday.

Discover great pre-Memorial Day deals on outdoor furniture at Wayfair to give your patio a stunning spring makeover.

Experts tip their hats and share their picks for the 2024 Kentucky Derby, plus how to watch or stream the race.

While CIA Director William Burns and Hamas representatives were in Cairo Saturday for cease-fire talks in the Israel-Hamas war, Israel said it is not sending a delegation until the militant group replies to Israel's latest proposal. Ramy Inocencio has the latest from Tel Aviv.

Janet Shamlian accompanied first responders Saturday in the Houston area as they conducted dangerous rescues in a water-logged region where floodwaters are still rising. Some areas of Texas have already seen 12 inches of rain in recent days, triggering mandatory evacuations.

The Biden administration has been focused intensely all week on pushing for a ceasefire and hostage release deal in the Israel-Hamas war. This comes as pressure grows politically, within the president's own party, over Israel's direction in the war. Natalie Brand reports from Washington.

Tensions escalated during protests at the University of Virginia Saturday, with Virginia State Police in gas masks and riot gear making arrests. At the University of Michigan, pro-Palestinian protesters paraded through the graduating class during the school's commencement ceremony. Amanda Starrantino has the latest on the unrest.

While CIA Director William Burns and Hamas representatives were in Cairo Saturday for cease-fire talks in the Israel-Hamas war, Israel said it is not sending a delegation until the militant group replies to Israel's latest proposal. Ramy Inocencio has the latest from Tel Aviv.

Janet Shamlian accompanied first responders Saturday in the Houston area as they conducted dangerous rescues in a water-logged region where floodwaters are still rising. Some areas of Texas have already seen 12 inches of rain in recent days, triggering mandatory evacuations.

The Biden administration has been focused intensely all week on pushing for a ceasefire and hostage release deal in the Israel-Hamas war. This comes as pressure grows politically, within the president's own party, over Israel's direction in the war. Natalie Brand reports from Washington.

Tensions escalated during protests at the University of Virginia Saturday, with Virginia State Police in gas masks and riot gear making arrests. At the University of Michigan, pro-Palestinian protesters paraded through the graduating class during the school's commencement ceremony. Amanda Starrantino has the latest on the unrest.

The majestic ocean liner the Queen Mary, once the playground for the rich and famous, fell into disrepair and was in danger of sinking until officials in Long Beach, California, gave it another shot. Tom Wait has more.

Andrew Carmellini has risen to the top of the culinary world, opening a bevy of restaurants in New York City over the past two decades. Now, his newest restaurant, Café Carmellini, is the first one that has his name on it. Jeff Glor has more.

It's been five years since a fire nearly destroyed France's iconic Notre Dame cathedral, but rebuilding work on the historic landmark is almost completed, thanks in part to the efforts of an American craftsman.

Jason de Leon has spent years studying undocumented migration and border concerns, trying to understand why people would leave their homes in search of new ones. The reasons can include climate change, poverty and violence, and in his newest book, Leon dives into clandestine border crossings like never before. Dana Jacobson has more.

Caitlin Clark and Angel Reese suited up as professionals for the first time Friday night as the brief league preseason begins.

Jordan’s Queen Rania Al Abdullah, who is of Palestinian descent, says Israel’s allies need to hold Israel accountable for its actions. She spoke with “Face the Nation” moderator Margaret Brennan about the U.S. support for Israel in the war against Hamas.

Born in a crucial time of need at the start of the pandemic, this organization began with a scrappy operation. Four million meals later, the Seva Collective has continued to grow.

Born in a crucial time of need at the start of the pandemic, this organization began with a scrappy operation. Four million meals later, the Seva Collective has continued to grow, bringing on new volunteers, partnering with food banks, companies and farms, and hosting special toy and clothing drives.

A widower finds a new purpose – in a Publix – after losing his wife. Then, volunteers in Southern California gather to work at a drive-thru that serves nutritious foods for those in need.

Back in March, two officers and a good Samaritan risked their lives to rescue a couple who were trapped in a burning home in Cape Coral, Florida.

A police officer becomes a guardian angel for a little girl struggling at school. A New Jersey toddler goes viral for the way she speaks, bringing joy and laughs to millions. A 7-year-old makes history at the rodeo. Plus, more inspiring stories.

Romance scammers drain billions of dollars from people seeking love, and their tactics have evolved in sinister ways in the online age. CBS News goes inside this devastating epidemic unfolding largely in secret, following the journey of an Illinois woman seeking answers after her mother’s mysterious death.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

Brian Fanion says he and his wife Amy Fanion had been arguing about his retirement plans when she picked up his service weapon and shot herself. Investigators did not believe his story.

The painter, sculptor and printmaker created work that was hailed as landmarks of the minimalist and post-painterly abstraction art movements.

It was just the 10th Kentucky Derby decided by a nose, and the first since Grindstone wore the garland of red roses in 1996.

Federal prosecutors said the men used fake badges, police lights and firearms to rob and kidnap Shamari Taylor for drug money.

Laborers, many of whom are migrants from Mexico, Guatemala, Venezuela or other Latin American countries, head to the tracks six days a week to help keep the $2.7 billion racing economy galloping.

Warren Buffett referred to close friend Charlie Munger as the "the architect of Berkshire Hathaway."

The retailer says the peelable treats have been "flying off the shelves" ever since TikTokers discovered the candy.

Audit firm BF Borgers allegedly failed to comply with accounting standards and fabricated audit documentation, regulators claim.

U.S. unemployment rate rose slightly to 3.9% in April, continuing a stretch of remaining under 4% for 27 months.

Job site Indeed identified the top 10 most sought-after job candidates by employers and recruiters. Here's what they found.

The decision prompted a wave of public backlash as women saw fertility treatments canceled or put in jeopardy after the ruling.

The hostage and cease-fire talks have taken on new urgency amid a looming Israeli ground invasion of Rafah, in southern Gaza.

Democratic Rep. Henry Cuellar of Texas was elected to the House in 2005 and represents the state's 28th Congressional District.

Ex-government employee Miguel Zapata is accused of sending fake FBI tips falsely accusing multiple coworkers of taking part in the Jan. 6, 2021, Capitol breach.

Roughly 100,000 immigrants who were brought to the U.S. as children are expected to enroll in the Affordable Care Act's health insurance next year under a new administration rule, the White House says.

The Texas dairy worker infected by H5N1 "did not disclose the name of their workplace," frustrating investigators.

Stress is hard to avoid, but experts say getting outdoors can have a positive impact on both our mental and physical health.

Actress Halle Berry joined with a group of bipartisan senators on Thursday to announce new legislation to promote menopause research, training and education.

New CDC data shows about 680 women in the U.S. died during pregnancy or shortly after childbirth in 2023, a decline from the previous year.

UnitedHealth Group CEO Andrew Witty disclosed that a cyberattack on one of its subsidiaries earlier this year might affect up to a third of all Americans.

Sadiq Khan, the Labour Party's mayor of London, has romped to victory, securing a record third straight term at City Hall, on another hugely disappointing day for the U.K.'s governing Conservatives ahead of a looming general election.

An adviser to Israeli Prime Minister Benjamin Netanyahu told CBS News that "the end of the war will come with the end of Hamas in Gaza."

Torrential rain pounding the area since Thursday triggered a landslide in Luwu district in South Sulawesi province, officials say.

In the past few weeks, flooding in Kenya and Tanzania killed hundreds after heavy rain during the region's monsoon season, officials said.

Three suspects were arrested and charged in the slaying of Hardeep Singh Nijjar by masked gunmen outside Vancouver.

Renowned artist Frank Stella, whose large-scale minimalist "Black Paintings" took the art world by storm in the 1950s, has died at the age of 87.

Oscar-winning actor Kevin Spacey fired back at fresh allegations of sexual harassment and assault from men who will feature as part of a documentary on British television.

We're counting down some of the most iconic Met Gala looks from the best dressed stars, like Rihanna, Bad Bunny, Zendaya and more.

In an effort to fully understand our nation's founding document, the New York Times bestselling author and humorist embarked on a year-long quest to be the original originalist. Muskets were involved.

Old 97's first started in Dallas as a popular bar band in the 90s, but since then, they've garnered a national fan base and critical acclaim. Now, three decades later, the alt-country pioneers are making a return visit to Saturday Sessions with their new studio album. From their new album "American Primitive," here are Old 97's with "Where The Road Goes."

Sidechat, an app launched in 2022 where students can post anonymously about their colleges, is becoming a tool for those choosing to protest at U.S. campuses. Amanda Silberling, a senior culture writer for TechCrunch, joins CBS News with more details on the app.

Microsoft users can now use biometric passkeys, like a thumbprint or Face ID, to sign into Microsoft 365, Copilot. Jon Fingas, senior editor at Techopedia, has more.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

Sidechat, an anonymous messaging app, has been used by students to share opinions and updates, but university administrators say it has also fueled hateful rhetoric.

Georgia is home to the nation's newest nuclear reactor. It's bringing clean energy to the state, but the project has run over budget and past its original completion date. Drew Kann, climate and environment reporter for The Atlanta Journal-Constitution, joins CBS News to explore the effort.

There's a newly-determined "major factor" in declining bumblebee populations – and it's attacking their nests.

On Monday, Boeing plans to launch astronauts on its new spacecraft that is called Starliner. The test flight to the International Space Station is years behind schedule.

Georgia is home to the nation's newest nuclear reactor. It's bringing clean energy to the state, but the project has run over budget and past its original completion date. Drew Kann, climate and environment reporter for The Atlanta Journal-Constitution, joins CBS News to explore the effort.

For the first time since 1803, two groups of periodical cicadas are emerging from the ground at the same time in parts of the Midwest and South. However, a small section of Central Illinois marks the only place where both the 13-year and 17-year cicadas are emerging in the same place. Dave Malkoff reports on the extraordinary event.

Much of Asia is sweltering under a heat wave that one expert calls "by far the most extreme event in world climatic history."

Brian Fanion says he and his wife Amy Fanion had been arguing about his retirement plans when she picked up his service weapon and shot herself. Investigators did not believe his story.

Federal prosecutors said the men used fake badges, police lights and firearms to rob and kidnap Shamari Taylor for drug money.

Police in Wisconsin fatally shot a student who had pointed a pellet rifle in their direction outside a middle school, according to the state's Department of Justice.

In one find, a K-9 officer helped police find over a dozen fish buried in the sand and hidden behind logs and brush piles.

Massachusetts investigators uncover a suspicious web history after Brian Fanion reports his wife Amy's death as a suicide.

Boeing is expected to launch its Starliner space capsule that will take two astronauts to the International Space Station. CBS News consultant Bill Harwood breaks down Boeing's mission.

It is the latest advance in China's increasingly sophisticated space exploration program, which is now competing with the U.S.

Boeing is set to launch its first-ever spaceflight with humans next week. The Starliner spacecraft will lift off from Florida on Monday night for a multi-day mission to the International Space Station. Commander Barry "Butch" Wilmore and pilot Sunny Williams, two seasoned NASA astronauts who are a part of the mission, join CBS News to go over the flight.

The Horsehead Nebula, which NASA has called "one of the most distinctive objects in our skies," is located in the constellation Orion.

Astronauts Barry Wilmore and Sunita Williams say they have complete confidence in the Starliner despite questions about Boeing's safety culture.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

Police investigate one of their own when a detective becomes a suspect in the shooting death of his wife. "48 Hours" contributor Nikki Battiste reports.

This marks the 11th year in a row that that every member of the graduating class at Southland College Prep Charter High School in suburban Chicago has been admitted to college. Noel Brennan explains the school's streak of academic excellence.

The majestic ocean liner the Queen Mary, once the playground for the rich and famous, fell into disrepair and was in danger of sinking until officials in Long Beach, California, gave it another shot. Tom Wait has more.

Basketball star Caitlin Clark made her WNBA preseason debut Friday before a sold-out crowd in Arlington, Texas. Clark finished with a team-high 21 points, but her Indiana Fever fell to the Dallas Wings 79-76.

While CIA Director William Burns and Hamas representatives were in Cairo Saturday for cease-fire talks in the Israel-Hamas war, Israel said it is not sending a delegation until the militant group replies to Israel's latest proposal. Ramy Inocencio has the latest from Tel Aviv.