At Trump trial, Stormy Daniels' ex-lawyer details interactions with Michael Cohen

An attorney who represented two women seeking payments in 2016 for their silence about alleged sexual encounters with Donald Trump is continuing his testimony.

Watch CBS News

An attorney who represented two women seeking payments in 2016 for their silence about alleged sexual encounters with Donald Trump is continuing his testimony.

President Biden said "no," the National Guard should not intervene in the protests.

College campus protests in solidarity with Palestinians amid Israel's war with Hamas in the Gaza Strip are spreading far beyond the U.S.

Jerry Boylan, was found guilty in 2023 of one count of misconduct or neglect of ship officer, colloquially known as seaman's manslaughter for the deaths of 33 passengers and one crew member on the dive boat Conception.

A Florida law prohibiting abortions after six weeks gestation with some exceptions went into effect Wednesday.

James Barbier, 79, is charged with first-degree murder in the 1966 stabbing death of 18-year-old Karen Snider at her home in Calumet City.

The IRS is tapping Inflation Reduction Act funding to hire more agents and go after more tax cheats. Here's where it is focusing.

U.S. Central Command initially said an airstrike in May 2023 had killed a senior al Qaeda leader in Syria, but an investigation has concluded it actually killed an innocent civilian.

Actress Halle Berry joined with a group of bipartisan senators on Thursday to announce new legislation to promote menopause research, training and education.

A field of 20 horses is set to launch from the starting gate for the 2024 Kentucky Derby on Saturday.

Authorities in Portland say an arsonist set fire to at least 15 police cars at a training facility early Thursday.

Police said the victims mixed the potion themselves and drank it "to acquire some certain kind of powers."

Shanidar Z's skull — thought to be the best preserved Neanderthal find this century — "was as flat as a pizza," experts said.

Family members said Heavenly Faith Garfield and the victim had been discussing the pact for several weeks, the affidavit says.

Lay it all out there next Valentine's Day with a "stress-free, clothes-free" cruise to the Caribbean.

Researchers say an orangutan appeared to treat a wound with medicine from a tropical plant.

Three years ago, Walter Hayes burst onto the music scene with "Fancy Like," a song that became a sensation and established his presence in the country music world.

It took nearly an hour and four people to get the 143-pound catfish out of the lake: "My wrist is still hurting from reeling."

Lawyers from Manhattan DA Alvin Bragg's office told the judge that Trump had violated the gag order four more times.

Prosecutors in former President Donald Trump's criminal trial in New York called their fifth witness to the stand.

She sent a letter to the Justice Department's Office of Professional Responsibility calling on it to open the investigation.

The ad, first shared with CBS News, features part of Donald Trump's interview with Time Magazine.

Several New York Democrats acknowledged that Republicans are more aggressively counterpunching on the issue of abortion in the 2024 election cycle.

Some have been on his list for months, while other candidates seem to be sliding out of favor.

Israeli Prime Minister Benjamin Netanyahu publicly rejects international pressure to call off an offensive on the southern Gaza city of Rafah.

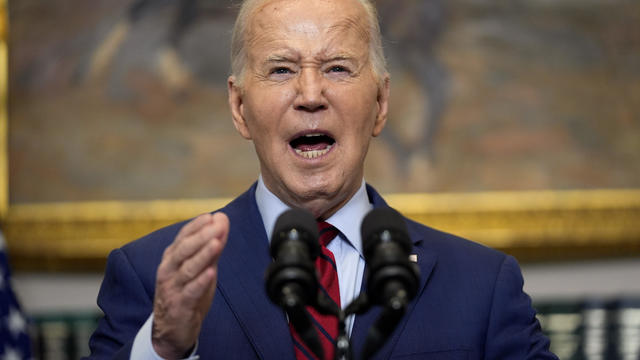

President Joe Biden addressed the nationwide protests in unscheduled remarks from the White House.

Antony Blinken conveys "cautious optimism" to hostage families that a deal could be reached.

If you're dealing with overwhelming debt, May could be the perfect month to pursue relief. Here's why.

Considering tapping into your home equity? Here's what could happen to home equity loan rates this month.

There are lots of great options to choose from if you're putting money in a CD account this month.

The recalled beef came from Cargill Meat Solutions in the form of burger patties and ground chuck.

The IRS is tapping Inflation Reduction Act funding to hire more agents and go after more tax cheats. Here's where it is focusing.

Licensing deal resolves months-long dispute that had record label Universal pulling its artists' music off the video platform.

The Fed is leaving its benchmark interest rate unchanged, noting a lack of progress in curbing inflation.

Plaintiffs have three months to vote on whether to approve a proposed legal settlement that would resolve nearly all talc lawsuits.

Diversify your cooking and streamline meal prep in the kitchen with one of the best food processors of 2024.

Give your patio a makeover this spring for just over $200 at Walmart ahead of Memorial Day weekend.

Experts tip their hats and share their picks for the 2024 Kentucky Derby, plus how to watch or stream the race.

President Biden on Thursday delivered remarks from the White House about the protests over the war in Gaza that have gripped college campuses across the country. "There's the right to protest," Biden said, "but not the right to cause chaos." Biden also said there was no place in America for antisemitism, Islamophobia, racism or hate speech. Nate Burleson anchored CBS News' special report.

Trillions of cicadas are emerging across 12 states, from the Midwest to the East Coast, after spending more than a decade underground. In Central Illinois, there is a rare opportunity to see two types of cicadas together for the first time in more than 200 years.

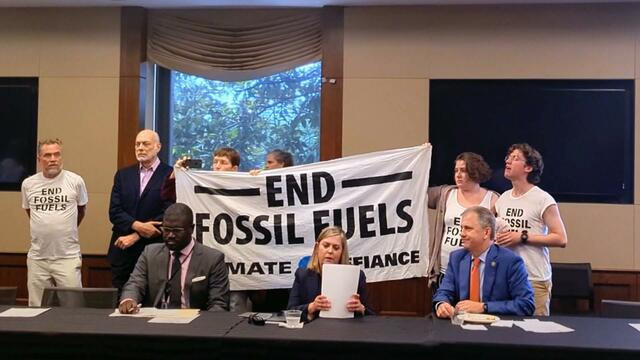

In the latest installment of our "Climate Watch" series, climate activists take bold measures, including blockading the entrance to Citigroup's global headquarters in Manhattan. Protesters are demanding the banking giant cease its funding of fossil fuels.

Police investigate one of their own when a detective becomes a suspect in the shooting death of his wife. "48 Hours" contributor Nikki Battiste reports Saturday, May 4 at 10/9c on CBS and streaming on Paramount+.

In this episode of "Person to Person with Norah O’Donnell," O’Donnell speaks with CVS Health CEO and author Karen Lynch about her life and career.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with author and professor Adam Grant about his newest book, as he discusses unlocking your hidden potential.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with author and professor Arthur Brooks about his partnership with Oprah Winfrey and the key to living a happier life.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with Senator Mitt Romney about his place in the Republican party, his family’s influence and what’s next for him in politics.

In this episode of Person to Person with Norah O’Donnell, O’Donnell speaks with Dolly Parton about her new book on her costumes and clothing and her new rock album.

Actress Halle Berry joined with a group of bipartisan senators on Thursday to announce new legislation to promote menopause research, training and education.

Still searching for the perfect Mother’s Day gift? Sarah Gelman, Amazon Books Editorial Director, shares her top book picks for all kinds of moms.

The students participated in a field day where they had a chance to go on the obstacle course, grab a bow and arrow and shoot at the archery range, and tryout adaptive cycles for the launch of the new adaptive program.

Judi Dench has tackled nearly every female role in William Shakespeare's plays, from Juliet to Cleopatra.

The change doesn't mandate or even explicitly affirm LGBTQ clergy, but it means the church no longer forbids them.

In Oklahoma, Nate Burleson shares his family’s personal connection to one of America’s darkest chapters. Then in Texas, we tour the renowned Kinsey Collection, the largest private holding of African American art and artifacts. Watch these stories and more on Eye on America with host Michelle Miller.

In California, we dine out at a restaurant powered by robots. Then in Washington, we take a sip of a beanless cup of coffee, which aims to reduce the environmental impact of the popular beverage. Watch these stories and more on "Eye on America" with host Michelle Miller.

In New York, we tour a unique museum that’s home to an extensive collection of toys, games and playgrounds. Then, we sit down with NBA superstar Steph Curry to discuss his heartwarming new children’s book. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Arizona, we learn why flag football is becoming an increasingly popular sport, especially among girls. Then in New York, we meet with descendants of some of the most notable suffragists of the 20th century. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Connecticut, we meet the preservationists who are giving dilapidated lighthouses new life. Then in California, we learn about the efforts to restore an iconic fishing boat. Watch these stories and more on "Eye on America" with host Michelle Miller.

A police officer becomes a guardian angel for a little girl struggling at school. A New Jersey toddler goes viral for the way she speaks, bringing joy and laughs to millions. A 7-year-old makes history at the rodeo. Plus, more inspiring stories.

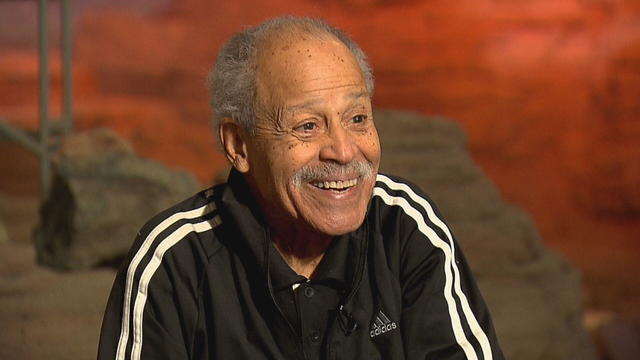

In 1961, Ed Dwight was selected by President John F. Kennedy to enter an Air Force training program known as the path to NASA's Astronaut Corps. But he ultimately never made it to space.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

A surfing accident left New York teacher Billy Keenan paralyzed, but when he received a call from a police officer, his life changed.

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

Romance scammers drain billions of dollars from people seeking love, and their tactics have evolved in sinister ways in the online age. CBS News goes inside this devastating epidemic unfolding largely in secret, following the journey of an Illinois woman seeking answers after her mother’s mysterious death.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

A Florida law prohibiting abortions after six weeks gestation with some exceptions went into effect Wednesday.

A Georgia senior living community fired an elderly worker shortly after honoring her as an employee of the year, regulators allege.

Jerry Boylan, was found guilty in 2023 of one count of misconduct or neglect of ship officer, colloquially known as seaman's manslaughter for the deaths of 33 passengers and one crew member on the dive boat Conception.

Authorities in Portland say an arsonist set fire to at least 15 police cars at a training facility early Thursday.

The IRS is tapping Inflation Reduction Act funding to hire more agents and go after more tax cheats. Here's where it is focusing.

A Georgia senior living community fired an elderly worker shortly after honoring her as an employee of the year, regulators allege.

The IRS is tapping Inflation Reduction Act funding to hire more agents and go after more tax cheats. Here's where it is focusing.

The recalled beef came from Cargill Meat Solutions in the form of burger patties and ground chuck.

Licensing deal resolves months-long dispute that had record label Universal pulling its artists' music off the video platform.

A man's physical and verbal threats caused the United flight from London to Newark, New Jersey, to divert to Bangor, Maine.

A Florida law prohibiting abortions after six weeks gestation with some exceptions went into effect Wednesday.

Joshua Dean was a quality inspector at Spirit AeroSystems, which builds the bulk of the 737 Max for Boeing, and recently died from a fast-spreading infection.

Researchers say an orangutan appeared to treat a wound with medicine from a tropical plant.

U.S. Central Command initially said an airstrike in May 2023 had killed a senior al Qaeda leader in Syria, but an investigation has concluded it actually killed an innocent civilian.

Actress Halle Berry joined with a group of bipartisan senators on Thursday to announce new legislation to promote menopause research, training and education.

Actress Halle Berry joined with a group of bipartisan senators on Thursday to announce new legislation to promote menopause research, training and education.

New CDC data shows about 680 women in the U.S. died during pregnancy or shortly after childbirth in 2023, a decline from the previous year.

UnitedHealth Group CEO Andrew Witty disclosed that a cyberattack on one of its subsidiaries earlier this year might affect up to a third of all Americans.

The USDA tested 30 samples from states with herds infected by H5N1.

Plaintiffs have three months to vote on whether to approve a proposed legal settlement that would resolve nearly all talc lawsuits.

College campus protests in solidarity with Palestinians amid Israel's war with Hamas in the Gaza Strip are spreading far beyond the U.S.

Police said the victims mixed the potion themselves and drank it "to acquire some certain kind of powers."

Israeli Prime Minister Benjamin Netanyahu publicly rejects international pressure to call off an offensive on the southern Gaza city of Rafah.

It took nearly an hour and four people to get the 143-pound catfish out of the lake: "My wrist is still hurting from reeling."

Mexico City's chief prosecutor disputed a volunteer group's claims that human remains and other evidence had been found at the site.

Three years ago, Walter Hayes burst onto the music scene with "Fancy Like," a song that became a sensation and established his presence in the country music world.

O'Donnell shared a photo of a script for season three, episode one of the Max show, revealing her character's name is Mary.

"Happy 9th Birthday, Princess Charlotte!" the Prince and Princess of Wales said in a social media post with a new photo of their daughter taken by Kate.

Emmy Award-winning actor Jeff Daniels says he's playing one of his most challenging roles yet. He stars in the new Netflix limited series "A Man in Full," created by Hollywood heavyweights David E. Kelley and Regina King, who also serves as a director. Daniels portrays Charlie Croker, a tough-talking real estate mogul facing bankruptcy. He must defend his empire and his family against enemies attempting to exploit his fall from grace.

Still searching for the perfect Mother’s Day gift? Sarah Gelman, Amazon Books Editorial Director, shares her top book picks for all kinds of moms.

Closing arguments begin Thursday in the Justice Department's antitrust lawsuit against Google. The government and more than a dozen states say Google has turned its search engine into an illegal monopoly, while Google says people like to use the engine and could change their search habits at any time. Matthew Perlman, senior competition reporter for Law 360, joins CBS News to discuss the case.

Pollen counters are turning to artificial intelligence as seasonal allergies worsen due to climate change. CBS News national correspondent Dave Malkoff explains how technology is changing the long and tedious process of pollen counting.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

Artificial intelligence assistants may soon be able to do much more than play your favorite music or call your mom, but some Google researchers warn about possible ethical dilemmas. CBS News reporter Erica Brown has more.

A newly-filed lawsuit targets two of the biggest generative AI platforms in the world, Open AI, the creators of ChatGPT and Microsoft's Copilot AI program.

Much of Asia is sweltering under a heat wave that one expert calls "by far the most extreme event in world climatic history."

Shanidar Z's skull — thought to be the best preserved Neanderthal find this century — "was as flat as a pizza," experts said.

The group of nations in the G7 have announced an agreement to phase out coal power plants by 2035. CBS News senior national and environmental correspondent Ben Tracy reports.

Blue holes are considered an "oasis" for marine life — but the Taam Ja' Blue Hole off the coast of Mexico remains largely mysterious.

Pollen counters are turning to artificial intelligence as seasonal allergies worsen due to climate change. CBS News national correspondent Dave Malkoff explains how technology is changing the long and tedious process of pollen counting.

Jerry Boylan, was found guilty in 2023 of one count of misconduct or neglect of ship officer, colloquially known as seaman's manslaughter for the deaths of 33 passengers and one crew member on the dive boat Conception.

Authorities in Portland say an arsonist set fire to at least 15 police cars at a training facility early Thursday.

A court hearing will be held in California on Thursday for Nima Momeni, the 38-year-old man accused of murdering Cash App founder Bob Lee. Momeni was arrested last year for allegedly stabbing Lee to death in San Francisco. He has pleaded not guilty. Jonah Owen Lamb, senior reporter for the San Francisco Standard, joined CBS News to discuss the case.

James Barbier, 79, is charged with first-degree murder in the 1966 stabbing death of 18-year-old Karen Snider at her home in Calumet City.

Family members said Heavenly Faith Garfield and the victim had been discussing the pact for several weeks, the affidavit says.

Boeing is set to launch its first-ever spaceflight with humans next week. The Starliner spacecraft will lift off from Florida on Monday night for a multi-day mission to the International Space Station. Commander Barry "Butch" Wilmore and pilot Sunny Williams, two seasoned NASA astronauts who are a part of the mission, join CBS News to go over the flight.

The Horsehead Nebula, which NASA has called "one of the most distinctive objects in our skies," is located in the constellation Orion.

Astronauts Barry Wilmore and Sunita Williams say they have complete confidence in the Starliner despite questions about Boeing's safety culture.

In 1961, Ed Dwight was selected by President John F. Kennedy to enter an Air Force training program known as the path to NASA's Astronaut Corps. But he ultimately never made it to space.

The creepy patterns were observed by the European Space Agency's ExoMars Trace Gas Orbiter.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

Closing arguments begin Thursday in the Justice Department's antitrust lawsuit against Google. The government and more than a dozen states say Google has turned its search engine into an illegal monopoly, while Google says people like to use the engine and could change their search habits at any time. Matthew Perlman, senior competition reporter for Law 360, joins CBS News to discuss the case.

A court hearing will be held in California on Thursday for Nima Momeni, the 38-year-old man accused of murdering Cash App founder Bob Lee. Momeni was arrested last year for allegedly stabbing Lee to death in San Francisco. He has pleaded not guilty. Jonah Owen Lamb, senior reporter for the San Francisco Standard, joined CBS News to discuss the case.

President Biden on Thursday addressed the campus protests over the war in Gaza, saying the National Guard should not be brought in to deal with the demonstrations, but that violent protests were not acceptable. CBS News national security contributor Samantha Vinograd commented on the public safety factors in the president's comments and CBS News senior White House and political correspondent Ed O'Keefe provided details on what prompted Mr. Biden to speak about the campus protests now.

Prosecutors in Donald Trump's New York criminal trial urged the judge to hold the former president in contempt of court for more gag order violations days after he was penalized for nine posts on social media and his campaign website. The judge did not immediately rule on the additional four alleged violations. CBS News correspondent Errol Barnett has more.

President Biden on Thursday delivered remarks from the White House about the protests over the war in Gaza that have gripped college campuses across the country. "There's the right to protest," Biden said, "but not the right to cause chaos." Biden also said there was no place in America for antisemitism, Islamophobia, racism or hate speech. Nate Burleson anchored CBS News' special report.