4th body recovered at Key Bridge collapse site; 2 still missing

A fourth body was recovered Sunday at the site of the Key Bridge collapse, according to the Unified Command.

Watch CBS News

A fourth body was recovered Sunday at the site of the Key Bridge collapse, according to the Unified Command.

The first criminal trial of a former president in U.S. history officially got underway in a crowded Manhattan courtroom, where jury selection has begun.

The fallout from the Jan. 6, 2021, attack will land before the Supreme Court on Tuesday when the justices consider the scope of a federal obstruction statute.

The House speaker says he wants to put up separate individual bills on aid for Ukraine, Israel, and Taiwan.

The union for American Airlines pilots says it's been seeing "a significant spike in safety- and maintenance-related problems in our operation."

President Biden believes painting former President Trump as a "threat" to democracy is a crucial contrast to highlight in his campaign.

"I dreamed of this moment since I was in second grade," Clark said.

Idaho Gov. Brad Little, a Republican, signed a bill into law last year that prohibits gender-affirming medical treatments for transgender minors.

Details emerge of Iran's unprecedented direct attack on Israel, and how it was largely thwarted by the U.S. ally's defenses.

Trump's trial will feature a unique cast of characters.

The case stems from a "hush money" payment of $130,000 to adult film star Stormy Daniels in 2016.

Potential jurors are facing a quiz like none other while being considered for a seat at Donald Trump's New York trial.

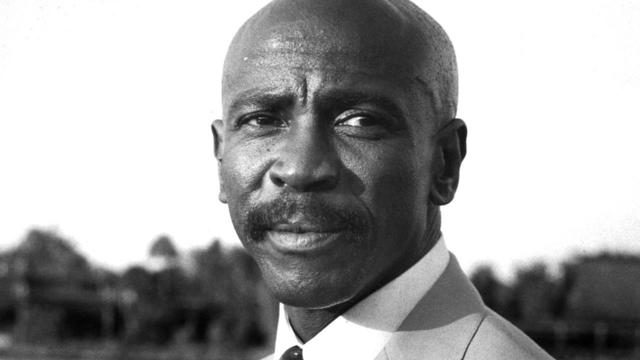

Earnest Horton founded Black Baseball Media, which gives players from predominantly underserved communities access to top-notch facilities and exposure to college scouts.

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

Nike's unitard for female track and field athletes representing the U.S. at the 2024 Paris Olympics is too revealing, critics say.

Amid complaints about alleged antisemitic views posted online, USC's valedictorian will not be permitted to deliver a speech at the university's commencement ceremony due to concerns about security, the school's provost announced today.

Bert Cullum, Tifany Machel Adams, Cole Earl Twombly and Cora Twombly are charged with murder in the disappearance of Veronica Butler and Jilian Kelley.

Hannah Gutierrez-Reed, the armorer on Alec Baldwin's film "Rust," was given the maximum sentence of 18 months in prison for involuntary manslaughter.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

Here's how much the billionaire "Shark Tank" investor owes the IRS.

For 36 years, John Sterling was the voice of the Yankees. His retirement will be recognized in a pregame ceremony on Saturday.

The casll came in a joint statement by twelve major news organizations including CBS News.

The Democratic National Committee paid it to firms representing Biden during special counsel Robert Hur's investigation.

The Arizona Supreme Court earlier this week upheld a 160-year-old total ban on abortions.

President Biden and Israeli Prime Minister Benjamin Netanyahu had a "good conversation," an official said.

President's handling hits new lows; Democrats have grown less supportive of aid to Israel.

Ameer, Hazem, and Mohammed Haniyeh were reportedly killed near the Shati refugee camp in Gaza City.

Gold bars and coins could be worth pursuing now that inflation is on the rise again.

There are options for tapping into your home's equity even if your mortgage loan is paid off. Here's what to know.

With inflation rising again, it makes sense to take advantage of what a high-rate CD can offer now.

The former president's media company has had a rough welcome on Wall Street, shedding two-thirds of its value since its peak.

Dream condiment now a reality: Heinz Classic Barbiecue Sauce available in the U.K. and Spain. Will "Kenchup" be next?

"It must be done," Tesla CEO Elon Musk said in a memo about the layoffs sent to employees on Sunday.

Nike's unitard for female track and field athletes representing the U.S. at the 2024 Paris Olympics is too revealing, critics say.

The housing market continues to be challenging for both buyers and sellers this year, as mortgage rates and asking prices continue to climb

Receive a $40 Digital Costco Shop Card when you join as a new member at Costco.com when entering PARA24 at checkout.

Caitlin Clark was the story of NCAA March Madness 2024. Now she's the top story of the WNBA. Get her jersey now.

Before you make the big move to the Big Apple, make sure your new home internet is the fastest, and offers the best value.

Trump's "hush money" trial began Monday, making him the first former U.S. president to stand criminal trial. More than half of the jurors questioned Monday were excused, with many saying they could not be fair and impartial. Robert Costa has more

The chief of staff for the Israeli military said there will be a response to the drone and missile attack Iran launched over the weekend. With the fear of sparking a wider regional war, many world leaders are calling for restraint. Debora Patta reports.

Protests cropped up in multiple cities across the U.S. on Monday demanding President Biden do more to broker a cease-fire in Gaza. Meanwhile, Mr. Biden is also urging Israeli Prime Minister Benjamin Netanyahu to be cautious about any response to Iran's recent attack on Israel. Weijia Jiang reports.

Former Iowa superstar Caitlin Clark was selected by the Indiana Fever with the first pick in the WNBA draft Monday night. Jan Crawford has more.

Trump's "hush money" trial began Monday, making him the first former U.S. president to stand criminal trial. More than half of the jurors questioned Monday were excused, with many saying they could not be fair and impartial. Robert Costa has more

The chief of staff for the Israeli military said there will be a response to the drone and missile attack Iran launched over the weekend. With the fear of sparking a wider regional war, many world leaders are calling for restraint. Debora Patta reports.

Protests cropped up in multiple cities across the U.S. on Monday demanding President Biden do more to broker a cease-fire in Gaza. Meanwhile, Mr. Biden is also urging Israeli Prime Minister Benjamin Netanyahu to be cautious about any response to Iran's recent attack on Israel. Weijia Jiang reports.

"Rust" armorer Hannah Guttierez-Reed was sentenced to the maximum 18 months in prison for her role in the fatal on-set shooting of the film's cinematographer. Actor and producer Alec Baldwin, who is charged with involuntary manslaughter, is still awaiting trial. Elise Preston reports.

Authorities found the remains of two bodies on Sunday believed to be two Kansas moms who went missing in Oklahoma last month. Four people, including the grandmother of one of the victim's children, were arrested and charged with murder over the weekend. Mark Strassmann has the latest.

Chicago public school teacher Earnest Horton is the founder of Black Baseball Media, which gives players from predominantly underserved communities access to top-notch facilities and exposure to college scouts. CBS Chicago's Charlie De Mar shares his story on Jackie Robinson Day.

Growing up, Morgan Price said she often felt isolated as one of the few Black gymnasts on her team, a challenge she overcame with the support of her family and, now, her teammates.

In "The Dish," Janet Shamlian visits The Greasy Spoon in Houston, Texas, where traditional Southern comfort dishes get a unique twist.

This week on CBS’s hit comedy "Ghosts," Rebecca Wisocky returns as the Gilded Age socialite Hetty, revealing surprising details about her character's past.

Morgan Price, a gymnast from Fisk University, has vaulted into history by becoming the first athlete from a historically Black college or university to win a national collegiate gymnastics championship. She joins "CBS Mornings" along with her mother to talk about her historic win.

Salman Rushdie has come to terms with the attempt on his life the only way he knows: by writing about it in his new book. He details the experience in his first television interview since the attack.

Thylacines — marsupials known as Tasmanian tigers — were declared extinct decades ago, but efforts to find one in the wild are thriving. Scientists are also working to bring back the species.

Cybersecurity investigators worry ransomware attacks may worsen as young, native-English speaking hackers in the U.S., U.K. and Canada team up with Russian hackers.

Artificial intelligence is being used as a way to help those dealing with depression, anxiety and eating disorders, but some therapists worry some chatbots could offer harmful advice.

Millions of landmines are spread across Ukraine. A massive effort is underway to find and remove the deadly devices, but it will take a generation or more to be rid of them.

Spencer, the official mascot of the Boston Marathon, is honored by his community. David Begnaud introduces us to a woman who calls herself a "bad weather friend" – because she's there when you need her most. Plus, more heartwarming stories.

Russ Cook says the scariest part of his run through Africa was "on the back of a motorbike, thinking I was about to die."

A trendsetting third grader creates a school tradition to don dapper outfits on Wednesdays. A retiree makes it her mission to thank those who may be in thankless jobs. Plus, more heartwarming and inspiring stories.

Lyn Story is a retiree whose mission is to be the "bad weather friend," someone who is there for you in a time of need. David Begnaud shows how her huge heart led to life-changing friendships.

Nets star Mikal Bridges fulfills his dream of teaching by working at a school in Brooklyn for the day. A doctor overcomes the odds to help other survivors of catastrophic injuries. Plus, behind the scenes of Drew Barrymore's talk show, and more heartwarming stories.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

President Biden believes painting former President Trump as a "threat" to democracy is a crucial contrast to highlight in his campaign.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

Earnest Horton founded Black Baseball Media, which gives players from predominantly underserved communities access to top-notch facilities and exposure to college scouts.

Caitlin Clark has been selected with the No. 1 pick in the WNBA draft by the Indiana Fever.

The housing market continues to be challenging for both buyers and sellers this year, as mortgage rates and asking prices continue to climb

The union for American Airlines pilots says it's been seeing "a significant spike in safety- and maintenance-related problems in our operation."

The housing market continues to be challenging for both buyers and sellers this year, as mortgage rates and asking prices continue to climb

The tax-prep software giant says it has resolved an issue that blocked some customers from e-filing on Sunday and much of Monday.

Nike's unitard for female track and field athletes representing the U.S. at the 2024 Paris Olympics is too revealing, critics say.

The former president's media company has had a rough start on Wall Street, shedding two-thirds of its value since its peak.

President Biden believes painting former President Trump as a "threat" to democracy is a crucial contrast to highlight in his campaign.

The House speaker says he wants to put up separate individual bills on aid for Ukraine, Israel, and Taiwan.

Idaho Gov. Brad Little, a Republican, signed a bill into law last year that prohibits gender-affirming medical treatments for transgender minors.

Iran's attack on Israel has renewed urgency in getting a Senate-passed bill through the House. But the bill also threatens Johnson's speakership.

Justice Clarence Thomas did not attend oral arguments at the Supreme Court on Monday.

Consumer complaints have risen in recent months of unauthorized enrollment in Affordable Care Act coverage.

Social services, such as parenting classes and economic development programs, can help, some health experts say. But insurers don't always cover these services.

George Schappell and sister Lori, of Reading, Pa., were the world's oldest conjoined twins, according to the Guinness Book of World Records.

Vice President Kamala Harris campaigned in Arizona Friday, where she blamed former President Donald Trump for the Arizona Supreme Court ruling earlier this week which could pave the way to revive a near-total abortion ban. Janet Shamlian has more.

Federal authorities are warning that unregulated Botox products are linked to an outbreak of botulism-like illnesses.

The House speaker says he wants to put up separate individual bills on aid for Ukraine, Israel, and Taiwan.

Iran's attack on Israel has renewed urgency in getting a Senate-passed bill through the House. But the bill also threatens Johnson's speakership.

American carpenter Hank Silver on why he couldn't turn down an opportunity to help resurrect Paris' Notre Dame cathedral from a devastating fire.

A now-viral video shows three other runners in a pack with Chinese runner Jie He, and one appears to wave him over just before the finish line.

Details emerge of Iran's unprecedented direct attack on Israel, and how it was largely thwarted by the U.S. ally's defenses.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

This week on CBS’s hit comedy "Ghosts," Rebecca Wisocky returns as the Gilded Age socialite Hetty, revealing surprising details about her character's past.

The comedian has stepped into his director's shoes for his new film, the not-quite-true story of the creation of the Kellogg's Pop-Tart.

Comedian Jerry Seinfeld has stepped into the director's shoes for his new Netflix film "Unfrosted," the not-quite-true story of the creation of the Kellogg's Pop-Tart. Correspondent Mo Rocca talks with Seinfeld about working behind the camera for the first time, and calling on a bunch of his comedian friends (including "Sunday Morning" contributor Jim Gaffigan) to act in his origin tale of a breakfast staple.

At the age of 28, Tyler Henry has become one of the best-known psychics anywhere, with a TV show, a road show and, he says, a 600,000-plus waiting list of people who want him to help them connect with their departed loved ones. Correspondent Tracy Smith sits down with Henry to discuss how he first recognized his ability at the age of 10; why he welcomes skepticism; and how he believes his talent helps people deal with grief.

The Biden administration is awarding Samsung $6.4 billion to expand American chipmaking. The company will spread the money across at least five facilities in Texas. Sujai Shivakumar, senior fellow at the Center for Strategic and International Studies, joins CBS News to assess the economic and technological impacts.

Roku said Friday a second security breach impacted more than 576,000 accounts after announcing in March that 15,000 accounts had been exposed by a hack. Emma Roth, a writer for The Verge, joins CBS News with more details.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

The bill reforms and extends a portion of the Foreign Intelligence Surveillance Act known as Section 702 for a shortened period of two years.

The feature will be turned on by default globally for teens under 18. Adult users will get a notification encouraging them to activate it, Meta said.

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

Only 5 to 6% of plastic waste produced in the U.S. is actually recycled. A new report accuses the plastics industry of a decades-long campaign to "mislead" the public about the viability of recycling.

Mexico City, one of the world's most populated cities with nearly 22 million people, could run out of water in months. Florencia Gonzalez Guerra, an investigative video journalist, joins CBS News to examine the causes behind the crisis.

Greenhouse gas emissions continued increasing in 2023, according to new data from the National Oceanic and Atmospheric Administration. CBS News' Elaine Quijano breaks down the numbers and what they mean for the climate.

The Biden administration awarded $830 million Thursday to fund projects that will address the impact of climate change on America's aging infrastructure. Ali Zaidi, an assistant to the president and national climate adviser, joins CBS News with more on the funding.

Hannah Gutierrez-Reed, the "Rust" Western film armorer who last month was found guilty of involuntary manslaughter in the deadly shooting of the film's cinematographer Halyna Hutchins, was sentenced to 18 months in prison for her part in the 2021 incident. CBS News legal contributor Jessica Levinson breaks down the sentencing.

Hannah Gutierrez-Reed, the armorer on Alec Baldwin's film "Rust," was given the maximum sentence of 18 months in prison for involuntary manslaughter.

A teenager has been arrested after a stabbing attack in a church in a Sydney suburb that officials Monday called "a terrorist incident."

Federal authorities are asking for the public's help in tracking down two men seen damaging popular rock formations at the Lake Mead National Recreation Area in Nevada.

The first criminal trial of a former president in U.S. history officially got underway in a crowded Manhattan courtroom, where jury selection has begun.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

It was a "bittersweet moment" as United Launch Alliance brought the Delta program to a close.

NASA flight engineers managed to photograph and videotape the moon's shadow on Earth about 260 miles below them.

Millions of Americans poured into the solar eclipse’s path of totality to watch in wonder. The excitement was shared across generations for the rare celestial event that saw watch parties across the country as almost all of the continental U.S. saw at least a partial solar eclipse.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

The Biden administration is awarding Samsung $6.4 billion to expand American chipmaking. The company will spread the money across at least five facilities in Texas. Sujai Shivakumar, senior fellow at the Center for Strategic and International Studies, joins CBS News to assess the economic and technological impacts.

Israel's military says it will retaliate after Iran and its proxies launched an attack of missiles and drones over the weekend. CBS News foreign correspondent Debora Patta reports. Then, CBS News senior White House correspondent Weijia Jiang explains the U.S.' role in the conflict.

The first criminal trial of a former U.S. president is underway. Jury selection began Monday in Donald Trump's New York "hush money" case. CBS News legal analyst Rikki Klieman joins to discuss.

Jury selection in former President Donald Trump's criminal "hush money" trial began Monday. CBS News chief election and campaign correspondent Robert Costa has more from the courthouse.

Severe thunderstorms, tornadoes and even hail are expected to sweep through parts of the Midwest this week. CBS News national correspondent Dave Malkoff has the details.